Tesla Inc., the electric vehicle and clean energy company founded by Elon Musk, has been a hot topic in the financial world for the past decade. With its innovative approach to transportation and energy, Tesla has disrupted traditional industries and has become a favorite among investors.

But what does the future hold for stock? In this comprehensive analysis, we’ll delve into various factors that could influence stock price in 2025.

Performance

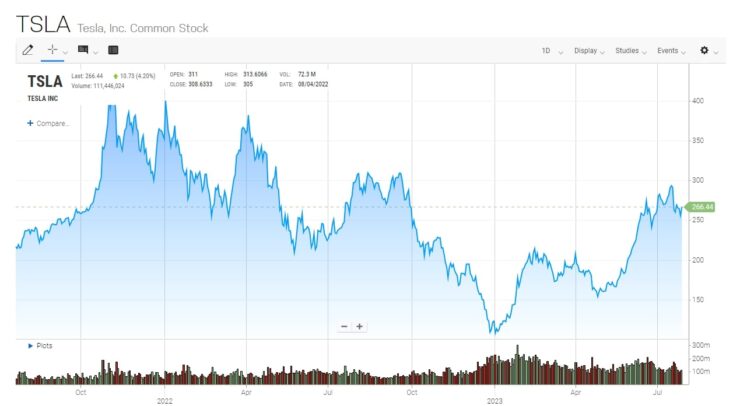

Tesla’s performance in the stock market has been a topic of intense discussion among investors and analysts alike. The company’s stock has seen a significant decline of 40 percent in 2022, causing its market cap to fall from 1 trillion dollars to 660 billion dollars.

This decline was primarily due to a decrease in demand for Tesla’s cars in China and a 9 percent decline in the price of vehicles. Furthermore, Tesla had to withdraw 54,000 cars due to software glitches.

Despite these setbacks, future still looks promising. Major brokerage houses like Credit Suisse, Canaccord Genuity, and Oppenheimer remain bullish on Tesla’s future. They predict that the company’s EPS growth this year will be 3.25, which is expected to increase to 5.60 next year.

Past Performance

The stock has seen a rollercoaster ride in recent years. In 2022, the company’s stock experienced a significant decline of 40 percent, causing the market cap to fall from 1 trillion dollars to 660 billion dollars.

This was primarily due to a decrease in demand for cars in China and a 9 percent decline in the price of Tesla vehicles. Furthermore, 54,000 cars were withdrawn due to software glitches.

Despite these setbacks, major brokerage houses like Credit Suisse, Canaccord Genuity, and Oppenheimer remain bullish on future. The company’s EPS growth this year is 3.25, which is expected to increase to 5.60 next year.

Current Performance

As of now, performance in the stock market has been a topic of intense discussion among investors and analysts alike. The company’s stock has seen a significant decline of 40 percent in 2022, causing its market cap to fall from 1 trillion dollars to 660 billion dollars.

This decline was primarily due to a decrease in demand for cars in China and a 9 percent decline in the price of Tesla vehicles. Furthermore, company had to withdraw 54,000 cars due to software glitches.

Despite these setbacks, future still looks promising. Major brokerage houses like Credit Suisse, Canaccord Genuity, and Oppenheimer remain bullish on the future. They predict that the company’s EPS growth this year will be 3.25, which is expected to increase to 5.60 next year growth.

Factors Influencing Tesla’s Future Stock Price

Several factors could influence Tesla’s stock price in 2025. These include the company’s financial performance, the growth of the electric vehicle market, and broader economic conditions.

Market Demand for Electric Vehicles

The demand for electric vehicles (EVs) is expected to rise significantly in the coming years. As the world moves towards more sustainable forms of transportation, EVs are becoming increasingly popular. Tesla, being a market leader in this segment, stands to benefit greatly from this trend.

Competition in the EV Market

While compnay currently holds a dominant position in the EV market, it faces potential threats from big companies like BMW and Renault.

If these companies can manufacture well-designed EV cars at lower prices, sales may see a decline. The ability of to maintain its competitive edge in the face of increasing competition will be a crucial factor influencing its future stock price.

Technological Advancements

Tesla is known for its innovative approach to technology. The company’s ability to continue developing and implementing cutting-edge technology in its vehicles will play a significant role in its future stock price.

Economic Conditions

The overall economic conditions, both in the US and globally, can also influence stock price. If the economies remain positive, the demand for electric cars is expected to increase.

Leadership

Elon Musk, the CEO of Tesla, SpaceX, and Twitter, plays a crucial role in the company’s success. His ability to effectively manage these responsibilities will have a significant impact on future stock price.

Broader Economic Conditions

https://youtu.be/4hWuBQwVNZQ

Broader economic conditions could also influence stock price. These include macroeconomic conditions, interest rates, and stock market trends.

Macroeconomic Conditions

Macroeconomic conditions, such as the state of the global economy, can have a profound impact on Tesla’s stock price. Economic growth can stimulate demand for Tesla’s products, while economic downturns can dampen it.

- Economic Expansion: If the global economy continues on an upward trajectory, this could spur demand for Tesla’s products, thereby supporting its stock price.

- Economic Recessions: Conversely, if the global economy experiences a downturn or recession, this could lead to a decrease in demand for products, which could exert downward pressure on its stock price.

The financial landscape in which operates is not isolated from the broader economy. Interest rates and overall stock market trends can significantly sway Tesla’s stock price. Higher interest rates can increase borrowing costs, while the general mood of the stock market can shape investor sentiment towards Tesla.

The Impact of Interest Rates

Interest rates, set by central banks like the Federal Reserve in the U.S., play a pivotal role in determining the cost of borrowing. As such, they can have a direct impact on Tesla’s financial health and, consequently, its stock price.

- Rising Interest Rates: If interest rates increase, borrowing becomes more expensive for companies like Tesla. This could potentially affect financial performance by increasing its cost of capital, which could, in turn, put downward pressure on its stock price.

- Falling Interest Rates: Conversely, if interest rates decrease, borrowing becomes cheaper. This could potentially improve Tesla’s financial performance by reducing its cost of capital, which could support or even boost its stock price.

Stock Market Trends and Investor Sentiment

The overall performance of the stock market can also influence Tesla’s stock price. The general mood or sentiment in the market can affect how investors perceive and react to Tesla’s performance.

- Bull Market Trends: In a bull market, where the overall trend is upward, investor sentiment tends to be positive. This could support stock price, as investors are more likely to invest in riskier assets like Tesla.

- Bear Market Trends: On the other hand, in a bear market, where the overall trend is downward, investor sentiment tends to be negative. This could put pressure on stock price, as investors are more likely to move away from riskier assets.

Tesla Stock Prediction 2025

Given these factors, what can we expect for Tesla’s stock price in 2025? While it’s impossible to predict with certainty, we can make some educated guesses based on the factors discussed above.

Market Position

Currently the market leader in the EV segment. However, the company faces potential threats from big companies like BMW and Renault. If these companies can manufacture well-designed EV cars at lower prices, sales may see a decline.

Elon Musk, the CEO, of SpaceX, and Twitter, holds 17.6% of Tesla’s shares. His ability to manage these responsibilities effectively will play a crucial role in Tesla’s future.

2025

Barclays and JP Morgan have given a Tesla stock price prediction for 2025 with a rise of 170%, reaching 480$ to 535$. This prediction is based on the assumption that the world will continue to move toward electronic vehicles.

2030

Analysts at Wallet Investor expect that the Tesla Company’s stock may see good growth in the future due to the increasing demand for electronic vehicles. Looking at the growth prospects of the model, the Tesla stock price prediction for 2030 will see it crossing $1000.

2040

The Tesla Company’s business is showing consistent performance. This quarter also saw an increase in sales of cars of close to 10%. But in the future, seeing the increasing craze of electronic vehicles, all the big automobile companies will be seen working in this segment.

However, company has the best software for the growth of its business. Due to this, the stock price prediction will be seen trading at a very high price in 2040.

Looking at the performance of the Tesla Company so far and the business model of the company, all the stock market experts believe that the stock of the Tesla Company can give good returns to its investors in the future.

FAQ

1. How does the order process work for a Tesla vehicle?

After designing and submitting your order for a Tesla vehicle, the company will contact you when your car is assigned a Vehicle Identification Number (VIN) and is ready for delivery.

If you wish to change your design, you can do so until the final invoice for your order is available in your Tesla Account. However, note that order changes may delay your delivery date.

2. What is a Tesla Account and what does it contain?

Your Tesla Account is the home for all your Tesla products. It includes owner resources, estimated delivery timing, registration information, guides, and important updates. You can visit your Tesla Account to upload required documents and submit your final payment. All information in your Tesla Account directly affects the spelling and punctuation on your registration documents.

3. How can I prepare for the delivery of my Tesla vehicle?

To prepare for delivery, you need to review and submit the documents listed in your Tesla Account. If you place your order in a country without Tesla delivery locations, your car will be delivered to Tesla’s Assembly Factory in the Netherlands. You must arrange carrier transportation of your car to the destination country.

4. What are the accepted methods of payment for a vehicle?

Tesla accepts final payment through a wire transfer only. They do not accept payments through credit card, debit card, or cheque. If your bank has a daily transfer limit, please ensure you allow enough time to complete your full payment at least 72 hours before the delivery appointment.

5. What kind of warranty does a vehicle come with?

Your Tesla is covered by the New Vehicle Limited Warranty which includes: Basic Vehicle Limited Warranty, Supplemental Restraint System (SRS) Limited Warranty, and Battery Limited Warranty.

These warranties cover the repair or replacement necessary to correct defects in the materials or workmanship of any parts manufactured or supplied by Tesla that occur under normal use.

Conclusion

Predicting the future is always a challenge, especially when it comes to the stock market. However, by considering the factors discussed above, we can make some educated guesses about the future of Tesla’s stock price.

In conclusion, Tesla’s stock price in 2025 will be influenced by a variety of factors. These include the company’s financial performance, the growth of the electric vehicle market, and broader economic conditions. While it’s impossible to predict with certainty, we can expect that stock price will continue to be subject to significant volatility.

As always, investors need to do their research and consider their risk tolerance when investing in stocks like Tesla. While compnay has the potential for significant growth, it also comes with significant risks. As the old saying goes, “Don’t put all your eggs in one basket.” Diversification is key when it comes to investing.

Sources:

https://www.globalsharetarget.com/2022/11/tesla-stock-price-prediction-2023-2025.html

https://coincodex.com/stock/TSLA/price-prediction/