In the dynamic world of investing, long-term growth stocks have always held a special place. These are the stocks that promise not just immediate returns, but a steady increase in value over the years.

They are the backbone of any robust investment portfolio, providing stability and the potential for significant returns in the long run. Today, we delve into the top 10 long-term growth stocks, as identified by Yahoo Finance, and explore what makes them such promising investment opportunities.

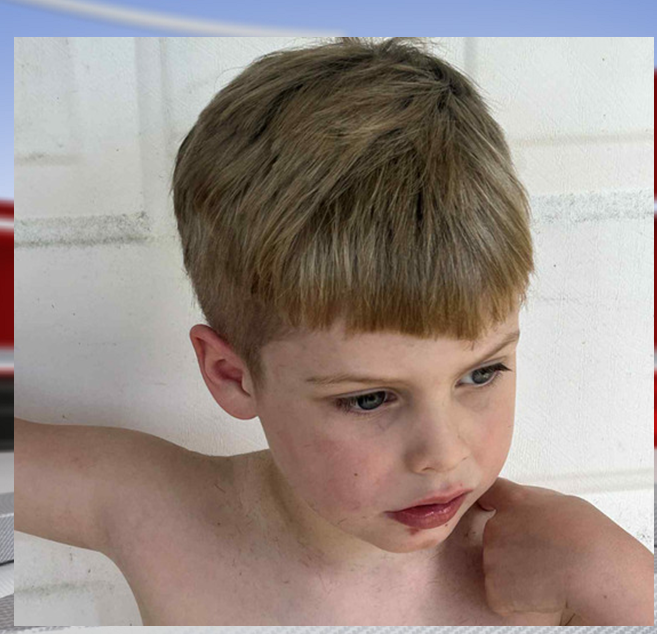

1. Amazon.com, Inc. (NASDAQ: AMZN)

Amazon, the e-commerce giant, has been a consistent performer in the stock market. Despite the market’s ups and downs, Amazon’s growth trajectory has remained largely unscathed.

The company’s diverse business model, which includes e-commerce, cloud computing, digital streaming, and artificial intelligence, provides it with multiple revenue streams, making it a resilient player in the market.

With its continuous innovation and expansion into new sectors, Amazon is poised for long-term growth.

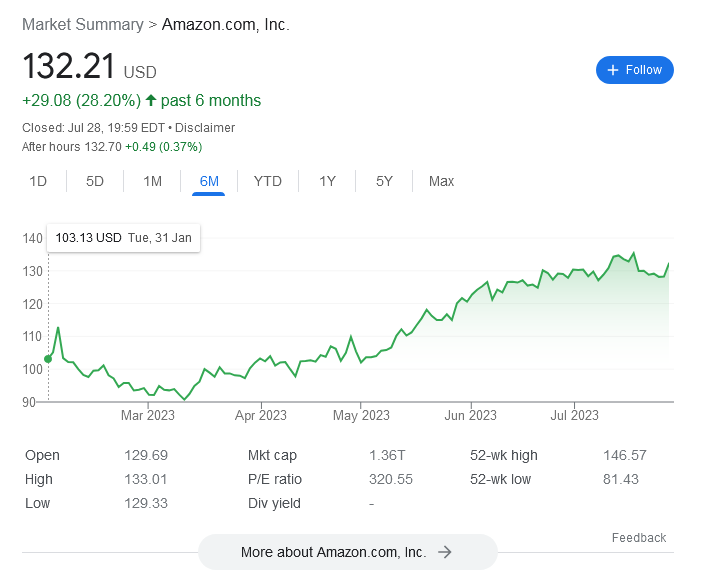

2. Alphabet Inc. (NASDAQ: GOOGL)

Alphabet, the parent company of Google, is another strong contender in the long-term growth category. The company’s core business, Google Search and Advertising, continues to dominate the market.

Additionally, its ventures into cloud computing, autonomous vehicles, and other tech-forward areas show promise for future growth.

Alphabet’s robust financial health and its commitment to innovation make it a solid choice for long-term investors.

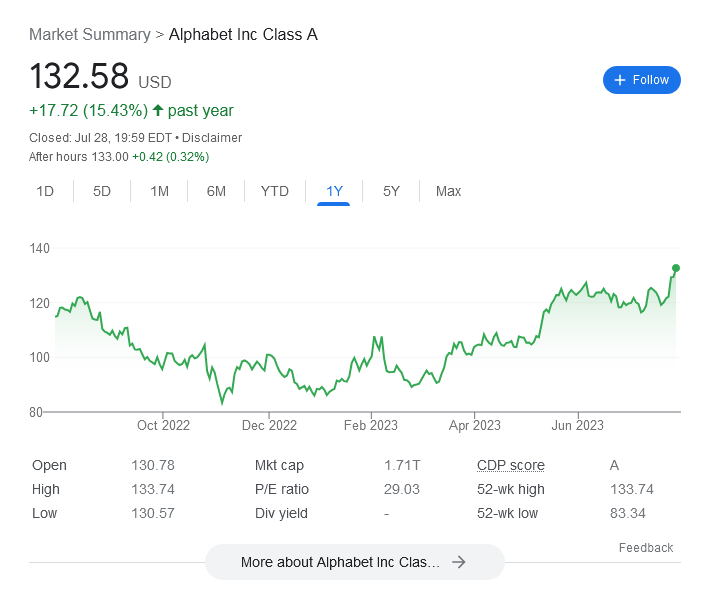

3. Apple Inc. (NASDAQ: AAPL)

Apple’s reputation as a leading technology company is well-deserved. Its innovative products, like the iPhone, iPad, and Mac, have a loyal customer base, ensuring steady revenue. Moreover, the company’s foray into services like Apple Music, iCloud, and the App Store has opened up new avenues for growth.

Apple’s strong brand and its continuous push for innovation make it a promising long-term investment.

4. Microsoft Corporation (NASDAQ: MSFT)

Microsoft’s transformation in recent years has been remarkable. The company has successfully shifted its focus from traditional software to cloud computing and AI, with its Azure platform showing impressive growth.

Microsoft’s diversified business model and its strong position in the enterprise software market make it a reliable choice for long-term growth.

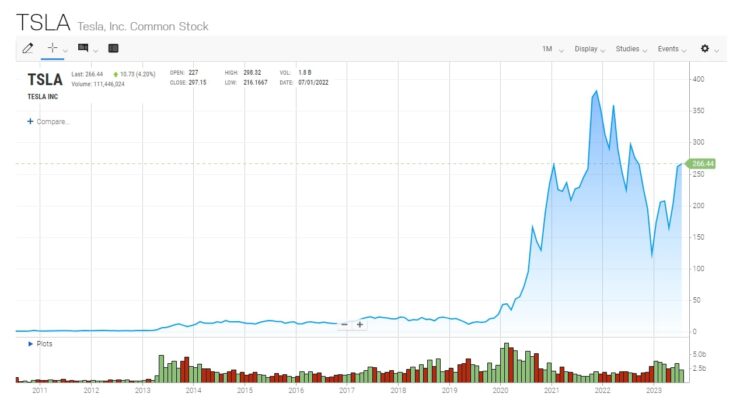

5. Tesla, Inc. (NASDAQ: TSLA)

Tesla has revolutionized the automobile industry with its electric vehicles. Despite facing intense competition, Tesla continues to lead the EV market, thanks to its superior technology and brand appeal.

The company’s commitment to innovation and its ambitious plans for the future, including autonomous vehicles and renewable energy solutions, make it a compelling choice for long-term investors.

6. The Home Depot, Inc. (NYSE: HD)

The Home Depot has consistently delivered strong financial performance, thanks to its dominant position in the home improvement retail market. The company’s focus on enhancing customer experience, both in-store and online, has paid off, driving growth.

With its robust business model and strong market position, The Home Depot is well-positioned for long-term growth.

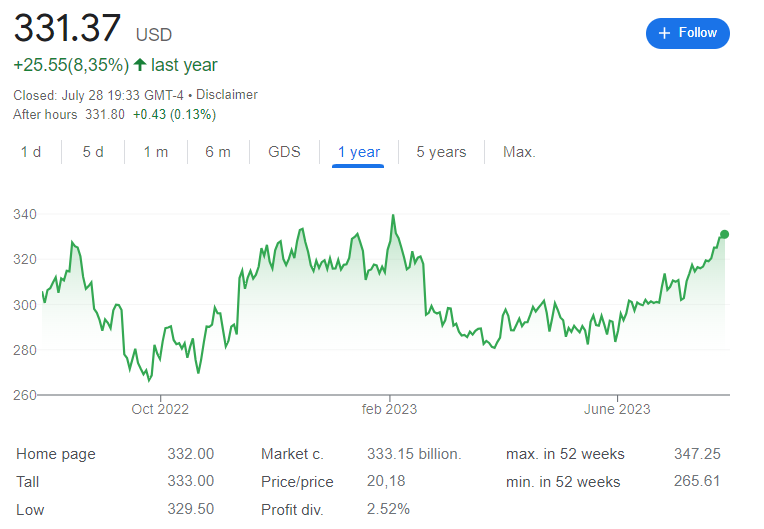

7. Visa Inc. (NYSE: V)

Visa, a global leader in digital payments, has a solid track record of growth. The shift towards cashless transactions, accelerated by the pandemic, has further boosted Visa’s prospects.

The company’s vast global network and its continuous efforts to innovate in the digital payments space make it a promising long-term investment.

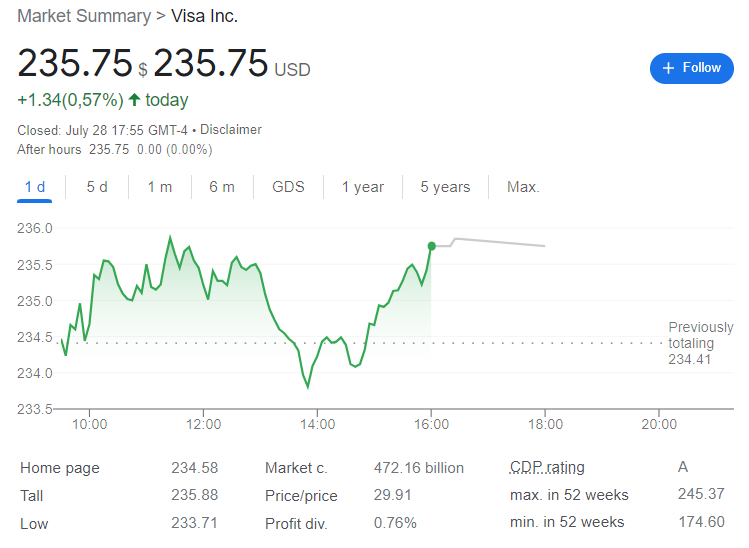

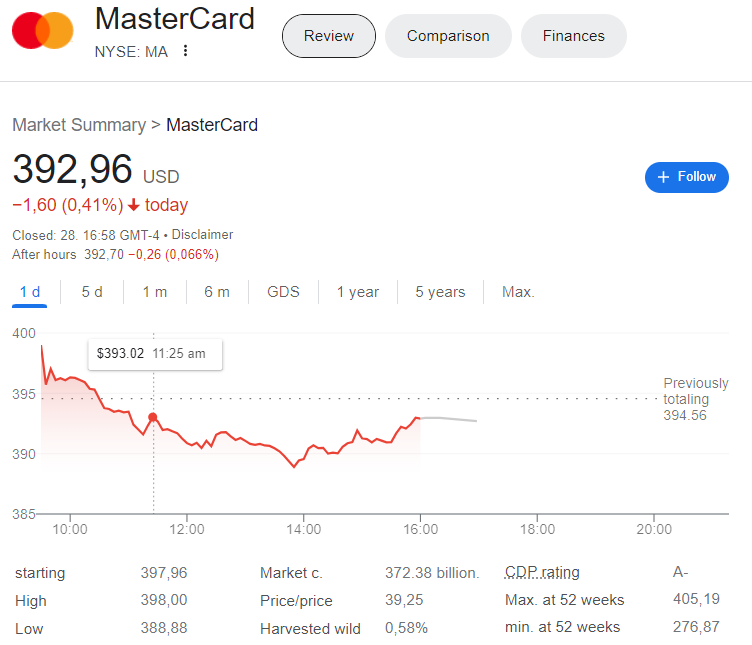

8. Mastercard Incorporated (NYSE: MA)

Like Visa, Mastercard has benefited from the increasing adoption of digital payments. The company’s strong brand, global reach, and its investments in new technologies, like blockchain and AI, position it well for future growth.

Mastercard’s resilient business model and its growth initiatives make it a solid choice for long-term investors.

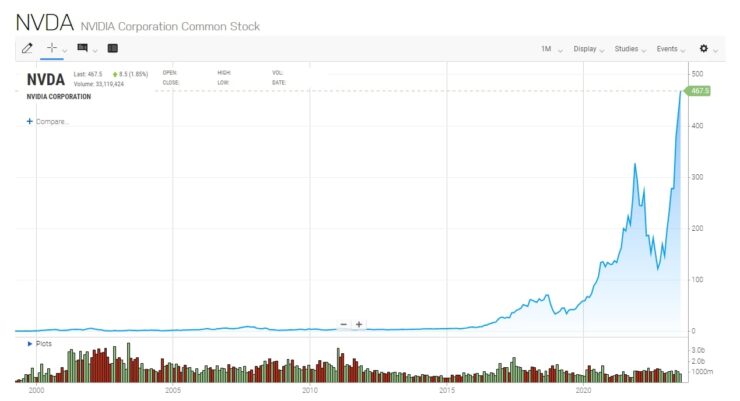

9. NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA, a leading player in the semiconductor industry, has seen impressive growth, driven by the increasing demand for its graphics processing units (GPUs) in gaming, data centers, and AI applications.

The company’s innovative products and its strong position in the growing semiconductor market make it a promising long-term investment.

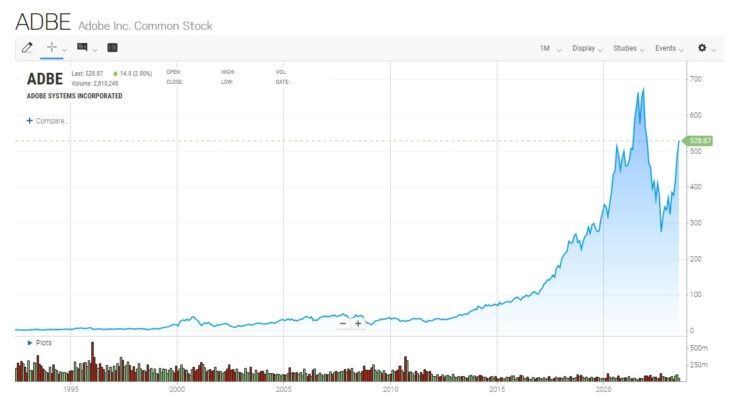

10. Adobe Inc. (NASDAQ: ADBE)

Adobe’s transition from boxed software to a cloud-based subscription model has been a resounding success. The company’s Creative Cloud, Document Cloud, and Experience Cloud platforms have seen strong adoption, driving growth.

Adobe’s strong market position and its continuous innovation in software solutions make it a compelling choice for long-term investors.

These ten companies, with their robust business models, innovative strategies, and strong market positions, represent some of the best opportunities for long-term growth in the stock market.

However, as with any investment, it’s crucial to conduct thorough research and consider your financial goals and risk tolerance before investing. Happy investing!

What are the best stocks past 20 years?

- Apple Inc. (AAPL): Apple’s stock has seen a massive increase in value over the past 20 years, driven by innovative products like the iPhone, iPad, and Mac.

- Amazon.com Inc. (AMZN): Amazon has grown from an online bookstore to a global e-commerce giant, with a corresponding increase in stock value.

- Alphabet Inc. (GOOGL): The parent company of Google, Alphabet has seen its stock value increase significantly due to the dominance of Google Search and the growth of other ventures like YouTube and Google Cloud.

- Microsoft Corporation (MSFT): Microsoft’s transition to cloud computing and subscription services has driven a significant increase in its stock value.

- Netflix Inc. (NFLX): As one of the first major streaming services, Netflix has seen a significant increase in its stock value as it has grown its subscriber base globally.

- Tesla Inc. (TSLA): Despite being a more recent entry to the market, Tesla’s focus on electric vehicles has led to a rapid increase in its stock value.

Which stock will grow in 10 years?

Predicting which specific stocks will grow over the next 10 years is challenging and inherently uncertain. The performance of a stock depends on a variety of factors, including the overall health of the economy, the company’s business model, its competitive position, and the industry in which it operates.

However, many financial analysts often look at certain sectors that are expected to grow significantly over the next decade. Here are a few sectors and some leading companies within them that are often mentioned:

- Technology: Companies like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) are expected to continue growing due to their strong market positions and continuous innovation.

- Electric Vehicles: Tesla (TSLA) and other electric vehicle manufacturers could see significant growth as the world shifts away from fossil fuels.

- Renewable Energy: Companies in the renewable energy sector, such as NextEra Energy (NEE), could benefit from the global shift towards clean energy.

- Healthcare and Biotechnology: With an aging population and advances in medical technology, companies like Johnson & Johnson (JNJ) and Moderna (MRNA) could see growth.

- E-commerce: As online shopping continues to grow, e-commerce giants like Amazon (AMZN) and Alibaba (BABA) could see continued growth.

- Cloud Computing and AI: Companies leading in cloud services and artificial intelligence, such as Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL), are poised for growth.

What is the most successful stock in history?

- Apple Inc. (AAPL): Since its initial public offering (IPO) in 1980, Apple’s stock has seen a massive increase in value, driven by innovative products like the iPhone, iPad, and Mac.

- Amazon.com Inc. (AMZN): Amazon’s stock has grown exponentially since its IPO in 1997. The company has transformed from an online bookstore to a global e-commerce giant, with a corresponding increase in stock value.

- Microsoft Corporation (MSFT): Since its IPO in 1986, Microsoft’s stock has seen significant growth. The company’s transition to cloud computing and subscription services has driven a significant increase in its stock value.

- Alphabet Inc. (GOOGL): The parent company of Google, Alphabet has seen its stock value increase significantly since its IPO in 2004 due to the dominance of Google Search and the growth of other ventures like YouTube and Google Cloud.

- Berkshire Hathaway Inc. (BRK.A): Led by Warren Buffett, Berkshire Hathaway has seen its stock price grow significantly over the decades. The company’s successful investment strategy has led to substantial growth in its stock value.

What’s the next big investment?

Predicting the “next big investment” is inherently uncertain and depends on a variety of factors, including market conditions, technological advancements, and societal trends. However, here are a few sectors that are currently attracting significant attention and could potentially offer substantial growth opportunities:

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are being integrated into a wide range of applications, from autonomous vehicles to personalized marketing and healthcare diagnostics.

- Green Energy: As the world shifts away from fossil fuels, companies in the renewable energy sector, particularly solar and wind, could offer significant growth opportunities.

- Electric Vehicles (EVs): With governments around the world setting ambitious targets for reducing carbon emissions, the demand for electric vehicles is expected to increase significantly.

- Biotechnology: Advances in genetic engineering, personalized medicine, and other biotech fields could potentially revolutionize healthcare and offer substantial investment opportunities.

- Blockchain and Cryptocurrencies: Despite their volatility, cryptocurrencies and the underlying blockchain technology have the potential to disrupt various industries, including finance, supply chain, and legal contracts.

- Space Exploration: Companies involved in space travel and exploration, satellite technology, and related fields could offer unique investment opportunities as the commercial space industry continues to develop.

- Remote Work Solutions: The COVID-19 pandemic has accelerated the shift towards remote work, potentially benefiting companies that offer remote collaboration tools, cybersecurity solutions, and cloud services.

What’s the most stable stock?

- Johnson & Johnson (JNJ): A multinational corporation that manufactures pharmaceutical and consumer packaged goods.

- Procter & Gamble Co (PG): A multinational consumer goods corporation with a wide range of popular products.

- The Coca-Cola Company (KO): A multinational beverage corporation known for its flagship product, Coca-Cola.

- Microsoft Corporation (MSFT): A multinational technology company known for its software products like Windows and Office.

- Walmart Inc. (WMT): The world’s largest retailer, known for its large discount department stores and grocery stores.

- McDonald’s Corporation (MCD): One of the world’s leading fast-food chains.