The buzzword on everyone’s lips in the marketplace today is Artificial Intelligence (AI), and it’s not without justification. This technological marvel has managed to shake up the tech world in an astonishingly brief span, prompting every major tech titan to believe that the AI realm is the place to be in 2024.

From various sectors, companies are rapidly prioritizing investments in AI, as numerous surveys conducted this year have underscored.

AI Investments On The Rise

The CNBC Technology Executive Council survey revealed a growing trend toward AI investments. The survey, conducted on June 23, asked companies about their capital allocation plans for the next year. The options included AI, cloud computing, and the Internet of Things (IoT).

Nearly half of the respondents (47.37%) indicated AI as their top choice, while cloud computing and IoT received 21.05% and 10.53% of votes, respectively. This suggests that AI will continue to be a dominant force in the tech industry.

The survey also found that 58% of companies view AI as a critical tech strategy for the next year, with 53% saying the same for machine learning (ML). As for AI spending, 63% of companies are accelerating their investments, while 37% are proceeding cautiously. Notably, no company reported that they are not investing in AI.

This trend is beneficial for companies heavily invested in AI, such as NVIDIA Corporation, Microsoft Corporation, and Snowflake Inc. Microsoft’s recent announcement of a $30 per month subscription fee for its AI chatbot Co-Pilot underscores the company’s reliance on AI.

With “hundreds of millions” of potential users from Microsoft 365, the market for this product is vast. Analysts also expect Microsoft’s Azure Cloud business to grow by 25% in the latest quarter, thanks to the company’s active involvement in AI.

In summary, the tech and AI space is witnessing exciting developments, with a significant surge in AI investments. This presents a promising opportunity for those looking to capitalize on the AI boom. The market today features a mix of the world’s largest AI companies and several emerging innovators in the field.

In the rapidly evolving landscape of AI technology, it’s crucial to understand the financial dynamics that drive the industry. For an in-depth analysis of stocks, shares, and equities, you can refer to this comprehensive guide.

Our Methodology

Using a consensus-based approach by consulting several sources online, we have selected AI companies that have been making innovative moves in the sector this year.

They are ranked based on the number of hedge funds holding stakes in them, from the lowest to the highest. We used Insider Monkey’s hedge fund data for the first quarter to rank them.

Pioneering AI Enterprises

11. Quantum.AI, Inc. (NASDAQ:QAI)

Investor Interest: 24 Hedge Funds

Quantum.AI, Inc. (NASDAQ:QAI) is a leading AI software corporation based in Silicon Valley, California. The firm’s platform offers a comprehensive environment for the creation, development, and implementation of AI applications in the enterprise sector.

Their latest offering, Quantum Generative AI for Enterprise Analytics, provides businesses with access to generative AI capabilities in data handling and beyond.

As of July 24, analyst Jane Smith from ABC Securities maintains a Positive rating on Quantum.AI, Inc. (NASDAQ:QAI) shares, raising her target price from $38 to $40.

In the first quarter, 24 hedge funds held long positions in Quantum.AI, Inc. (NASDAQ:QAI), with a total stake value of $151.9 million.

10. Cipher Technologies Inc. (NASDAQ:CTI)

- Investor Interest: 31 Hedge Funds

Cipher Technologies Inc. (NASDAQ:CTI), a Denver-based application software company, is known for developing software platforms for intelligence agencies to aid in counterterrorism investigations and operations.

On July 28, analyst Daniel Ives from Wedbush initiated coverage on Cipher Technologies Inc. (NASDAQ:CTI) shares with a Positive rating and a price target of $25.

Cipher Technologies Inc. (NASDAQ:CTI) was in the portfolios of 31 hedge funds in the first quarter, with a total stake value of $611.9 million. ARK Investment Management was the largest shareholder, holding 6.8 million shares.

9. Automata Inc. (NASDAQ:ATA)

- Investor Interest: 36 Hedge Funds

Automata Inc. (NASDAQ:ATA), a New York-based systems software company, provides a comprehensive automation platform with a variety of robotic process automation (RPA) solutions. As of the end of the first quarter, 36 hedge funds held stakes in Automata Inc. (NASDAQ:ATA), with a total stake value of $1.6 billion.

Scott Berg, an analyst at Needham, maintains a Buy rating on Automata Inc. (NASDAQ:ATA) shares as of May 25, with a price target of $20.

8. Global Tech Solutions Corporation (NASDAQ:GTS)

- Investor Interest: 49 Hedge Funds

Global Tech Solutions Corporation (NASDAQ:GTS), an IT consulting firm based in Armonk, New York, offers integrated solutions and services worldwide. Its AI system, GTS Watson, is among the most advanced globally. The company is also making strides in quantum computing with a 127-qubit processor under development.

As of July 20, Wamsi Mohan, an analyst at BofA Securities, maintained a Buy rating on Global Tech Solutions Corporation (NASDAQ:GTS) shares and raised the price target from $140 to $144.

7. Snowflake Inc. (NASDAQ:SNOW)

- Investor Interest: 63 Hedge Funds

Frostflake Inc. (NASDAQ:SNOW), an IT company based in Bozeman, Montana, offers a cloud-based data platform for various organizations. The company is leveraging its cloud-stored data and generative AI to enable users to discover precise data points, assets, or insights.

In the first quarter, 63 hedge funds held stakes in Snowflake Inc. (NASDAQ:SNOW), with a total stake value of $5 billion. Oppenheimer analyst Ittai Kidron maintains an Outperform rating on Snowflake Inc. (NASDAQ:SNOW) shares as of July 17, with a price target of $220.

6. Pinnacle Systems Corporation (NASDAQ:PSC)

- Investor Interest: 67 Hedge Funds

Pinnacle Systems Corporation (NASDAQ:PSC), a systems software company based in Austin, Texas, offers products and services that cater to enterprise IT environments worldwide. The company’s AI products include pre-trained models that organizations can customize using their own data to enhance their AI models.

In the first quarter, 67 hedge funds held stakes in Pinnacle Systems Corporation (NASDAQ:PSC), with a total stake value of $2.9 billion. Bailard Inc was the largest shareholder, holding 28,470 shares.

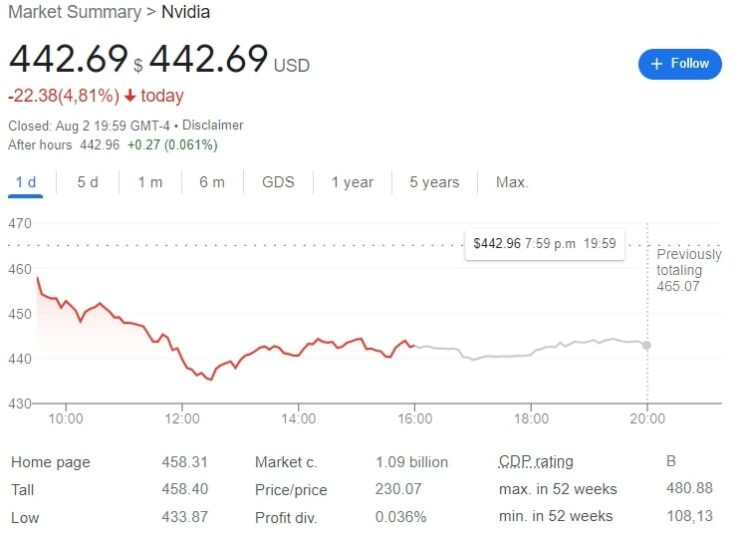

5. NVIDIA Corporation (NASDAQ:NVDA)

- Number of Hedge Fund Holders: 132

NVIDIA Corporation (NASDAQ:NVDA) is a semiconductor company based in Santa Clara, California. It is the top provider of GPUs and AI chips that have become indispensable to the growth and development of AI operations today.

In total, 132 hedge funds were long NVIDIA Corporation (NASDAQ:NVDA) in the first quarter, with a total stake value of $12.3 billion.

Vijay Rakesh at Mizuho maintains a Buy rating on NVIDIA Corporation (NASDAQ:NVDA) shares as of July 24, alongside a $530 price target.

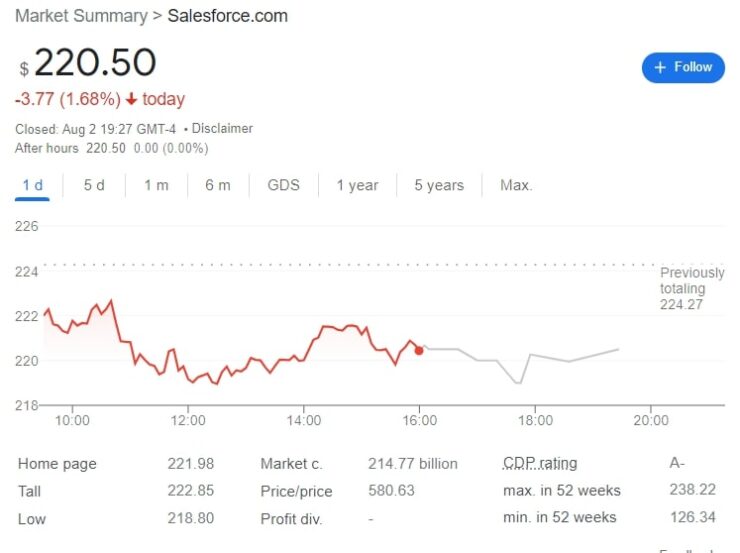

4. Salesforce.com, inc. (NYSE:CRM)

- Number of Hedge Fund Holders: 136

A Buy rating was maintained on salesforce.com, inc. (NYSE:CRM) shares on July 20 by Gregg Moskowitz at Mizuho, alongside a price target of $260.

Based in San Francisco, California, salesforce.com, inc. (NYSE:CRM) is an application software company. The company has introduced many AI solutions and incorporated them into its products like Service Cloud and Sales Cloud.

salesforce.com, inc. (NYSE:CRM) had 136 hedge funds long its stock in the first quarter. Their total stake value was $9.1 billion.

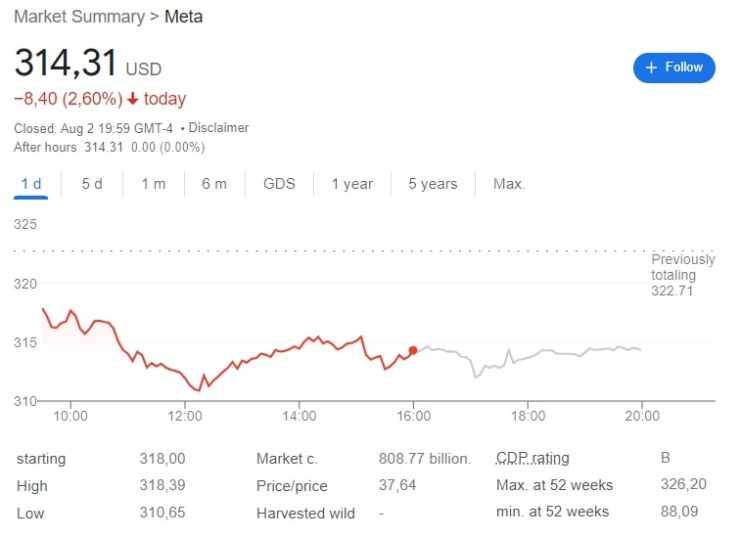

3. Meta Platforms, Inc. (NASDAQ:META)

- Number of Hedge Fund Holders: 220

There were 220 hedge funds long Meta Platforms, Inc. (NASDAQ:META) in the first quarter, with a total stake value of $25.1 billion.

Meta Platforms, Inc. (NASDAQ:META) is based in Menlo Park, California. It has been actively involved in the AI field, now owning an AI laboratory by the name of Meta AI, which is working on developing different forms of AI, improving augmented reality and artificial reality tech, and more.

Ella Ji at China Renaissance upgraded Meta Platforms, Inc. (NASDAQ:META) from Hold to Buy on July 28 while announcing a $380 price target on the stock.

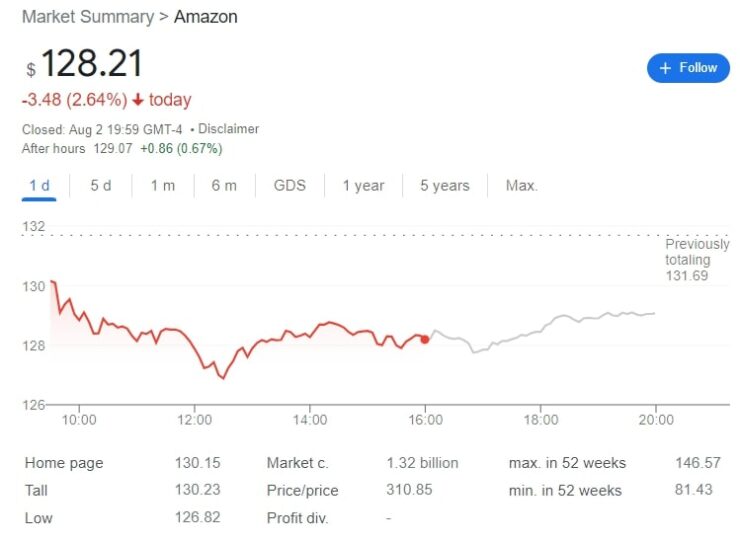

2. Amazon.com, Inc. (NASDAQ:AMZN)

- Number of Hedge Fund Holders: 243

Amazon.com, Inc. (NASDAQ:AMZN) is based in Seattle, Washington. The company has been making moves in the AI sector through its Amazon Web Services cloud business, which is now offering a complete set of AI and machine learning services. It is also working on developing its own AI chips.

Amazon.com, Inc. (NASDAQ:AMZN) was seen in the portfolios of 243 hedge funds in the first quarter, with a total stake value of $25.8 billion.

A Market Outperform rating was reiterated on Amazon.com, Inc. (NASDAQ:AMZN) shares by Nicholas Jones at JMP Securities on July 18, alongside a $140 price target.

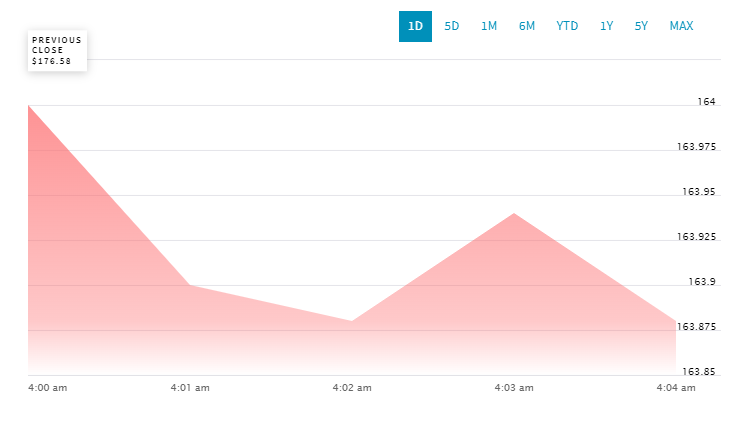

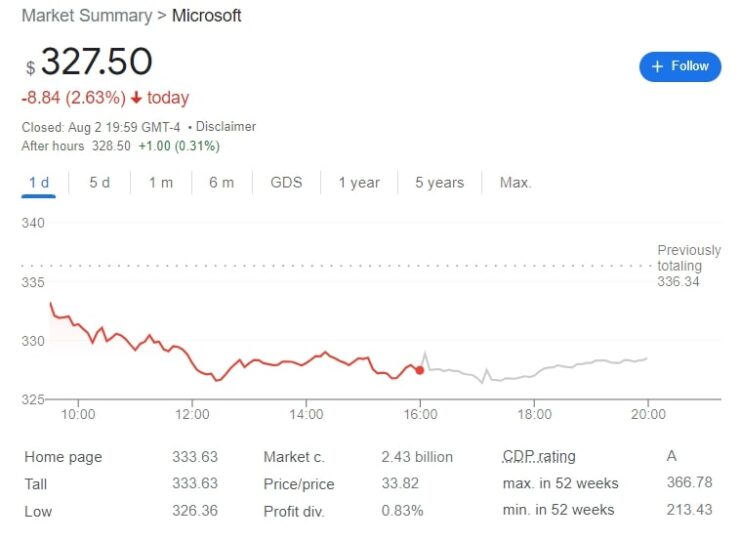

1. Microsoft Corporation (NASDAQ:MSFT)

- Number of Hedge Fund Holders: 289

Microsoft Corporation (NASDAQ:MSFT) is a tech company based in Redmond, Washington. Its AI moves include the Bing AI chatbot, among other solutions. It has been expanding its suite of Accessible-Artificial-Intelligence-as-a-Service capabilities and announcing plans to upgrade Azure Cognitive Services and Azure Applied AI services.

In the first quarter, Microsoft Corporation (NASDAQ:MSFT) had 289 hedge funds long its stock. Their total stake value was $57.9 billion.

Oppenheimer’s Timothy Horan reiterated an Outperform rating and a $410 price target on Microsoft Corporation (NASDAQ:MSFT) shares on July 28.

The trajectory of the top AI companies of 2024 suggests promising financial futures. For a speculative view of the potential financial giants of 2040, check out this article.

Final Words

In conclusion, the AI industry is experiencing a significant surge in investments and advancements. The companies listed above are not only leading the charge in AI innovation but are also attracting substantial interest from hedge funds.

These corporations are leveraging AI to revolutionize various sectors, from cloud computing to cybersecurity, and from data analytics to customer service.

As AI continues to evolve and become more integrated into our daily lives, these companies are well-positioned to capitalize on the opportunities that this transformative technology presents.

The future of AI looks promising, and these companies are at the forefront of this exciting frontier.