The digital currency market has been through many ups and downs in the last decade or so. It was introduced to the public back, which was nothing short of a revolution in the world of finances. To be honest, it wasn’t realistic to expect that this market would be at the level it is today. But when we reflect on the last decade or so, we can see that its evolution was quite a ride that changed the way we see markets today.

As you probably know, there were several bumps on this road. The most prominent one occurred back in 2020, during the time of COVID-19, when Bitcoin lost roughly two-thirds of its value in less than two months. However, it managed to get back several months ago and reach its record value. Following the value is possible through prominent exchanges such as Binance.

Today, we want to talk about some indicators that say Bitcon’s value is about to decrease once again.

Drop in Trading Volume

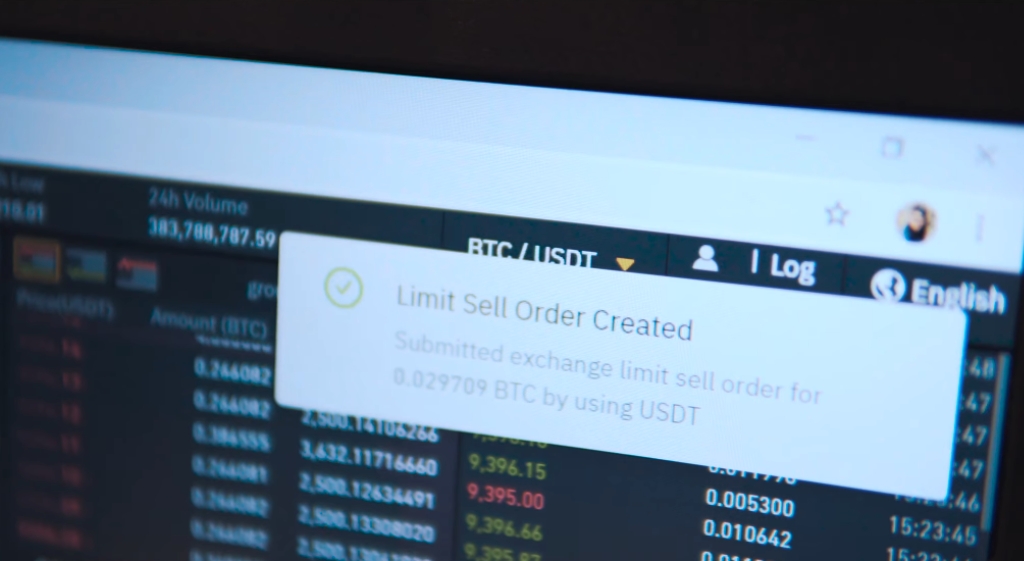

One of the things that was the main drive-force behind the value of Bitcoin was the trading volume. Over the years, we could see that this volume went up and came down exactly during the times of the biggest volatility its price has witnessed in its history. It is a sign that the traders need to think about their next moves.

If you go to the report conducted by CoinGecko, you will see that trading volume has dropped in the last quarter. It amounted to somewhat higher than $720 billion. But if you know that the previous quarter amounted to more than $1 trillion, it is safe to say that something is about to happen. If this trend persists, significant changes are likely to happen.

Veterans in the market know that the record low occurred back in 2019. When you compare the market of today to how it looked back then, this indicates that everybody should expect a drop. Of course, we must say that this is not set in stone. There is always a chance something will happen that will guide the metrics to higher levels, but we need just to wait and see what happens.

Bitcoin and US Dollar

American fiat currency is the most widespread in the world, involved in most transactions which amounts to its value. S, nobody should be surprised that the current state of the dollar has to do with the decline of Bitcoin. Not only that, it is also more than clear that gold, which is the world’s largest reserve asset in the world has also taken a hit. The combined drop in gold and the US dollar might indicate a new hit for the cryptocurrency market, especially Bitcoin.

Even though the dollar has suffered a hit since the start of 2022, there are some signs of recovery. June 2024 was particularly important in this regard. It was when the US dollar was able to recover and put a stop to the trend of devaluation against other currencies, like the Swiss Franc, or British Pound. It is important to point out that this can lead to the stabilization.

Still, markets need time before they can stabilize. Therefore, it is highly likely that this hit we’re mentioning is happening. But after this happens, it can be a major force behind a new raise. Some voices claim that the record value of BTC will be overtaken in the future precisely for this reason. Once again, these are predictions. Who knows what can happen in the foreseeable future?

Social Network Activity

You will agree that social media trends are good indicators of what is about to happen, or at least what sparks the interest in the global community. What is interesting about this element is that the “Bitcoin” search is at a high level. It hasn’t been higher since 2017. Naturally, there are several ways this interest can lead to. For instance, maybe this decline is what sparks the interest.

Of course, sparking an interest in a deteriorating tendency is something that might lead to something in the future. We can see that some of the platforms have changed their algorithm some months ago. Still, this keyword persists and it is higher than it was in a long time, six years, to be precise.

It is unclear whether this spike in interest in social media will lead to something beneficial for the market. It can go two ways, it can be quite beneficial, or quite a big drop. Staying in the position it is now is not likely to happen, we are certain of that.

As we delve into the current trends shaping the cryptocurrency landscape, it’s imperative to consider the long-term vision and analytical insights offered in our exploration of future projections for digital currency, creating a cohesive narrative that bridges the gap between the immediate market metrics discussed here and a broader perspective on Bitcoin’s trajectory.

Decrease in Google Search Traffic

The final indicator we want to talk about is the drop in Google search traffic when it comes to Bitcoin and the digital currency market as a whole. It must be said that the levels keywords “Bitcoin” and “Cryptocurrency” are yet to reach the traffic they had back in September 2019. Knowing that it is easier to see that the public in general is simply less interested in this subject, which leads to a drop in trading.

Sure, the Google search traffic for these keywords is somewhat stable at the moment, but it is important to say that the trend of decline hasn’t been reversed. There are several ways this decline can be explained. But the most prominent reason is the appearance of numerous trading alternatives you can find all over the internet. You will certainly agree that people generally want to test out new things since the chances of success tend to be higher.

The Bottom Line

Bitcoin came and changed the world, we can say that with the utmost assurance. While it is not expected that this concept will fail in the end, we can be sure that the challenges it faces are yet to be expected due to the many alternatives that appeared. We are certain that you will find this insight of ours useful.

As we delve into the dynamic world of cryptocurrency, it’s essential to consider alternative investment options, and here, we discuss promising digital assets, providing a valuable segue to the nuanced analysis in another insightful piece on Bitcoin’s trajectory.