Investing in football clubs has always intrigued me, and it’s not just an arena for the high-rollers or die-hard fans anymore. As of 2024, many of the world’s football clubs have gone public, allowing people like me to invest in them through the stock market. This opportunity to be part of the ups and downs of these clubs is more than just financial; it’s a chance to be part of a global phenomenon where football is not just a sport but a significant business entity.

For me, the excitement of owning shares in a football club is twofold. As a fan, it’s thrilling to be part of my favorite club’s journey, feeling a deeper connection with every game they play. As an investor, I see the potential in the diverse revenue streams these clubs tap into, from broadcast rights to merchandising. It’s fascinating how the clubs’ on-field performances can influence their stock values, adding another layer of engagement to my experience as a spectator. However, I’m also mindful of the risks involved, such as management decisions, team performance, and regulatory changes, which can all affect the value of my investment.

Key Takeaways

- Fans and investors can buy shares in some top football clubs, reflecting the sport’s status as a global business.

- Club shares offer a mix of emotional and financial investment, tapping into diverse revenue streams.

- On-field performance can influence club stock prices, highlighting the unique risks of football investments.

- Investing in football clubs listed on the stock market offers a unique opportunity for portfolio diversification. Unlike traditional stocks, these investments allow individuals to diversify into the sports entertainment sector, which can behave differently from other market segments.

- The valuation of publicly traded football clubs can be significantly impacted by global events, such as major tournaments, changes in sports broadcasting rights, and even socio-political factors.

- While the emotional connection of investing in a beloved football club can be a driving factor, it also poses a unique risk. Investors’ decisions may be influenced more by their loyalty to the club rather than grounded financial analysis.

Overview

I’ve been closely observing the trend of football clubs listing on the stock market. In 2024, numerous fans and investors alike have the opportunity to buy shares of their favorite teams. This phenomenon allows for a unique fusion of sports fandom with financial investment.

The stock market presence of football clubs varies around the globe, with listings on exchanges such as the NYSE, BIT, and DAX. For instance, clubs like Manchester United are traded on the New York Stock Exchange, allowing global investors to participate in their financial journey as noted by Reuters. Others, such as Juventus, Borussia Dortmund, and Celtic, find their place on European exchanges.

Below is a concise list highlighting several clubs that have entered the stock market:

- Manchester United (NYSE)

- Juventus (BIT)

- Borussia Dortmund (DB)

- Celtic (AIM)

The integration of football clubs into the stock exchange heralds a new era where fans can claim a stake in a club’s future. I take interest in both the financial performance and its impact on the sports community. Considering factors like branding, revenues generated from broadcasts, sponsorships, and merchandise sales, the performance of these stocks can be volatile and closely tied to the club’s on-pitch success. However, navigating the intersection of sports and finance requires a blend of passion and prudence.

15 Football Clubs Listed on Exchanges

Investing in football is not just for the high-rolling elite; average investors can also partake by purchasing shares of some of the top European football clubs that are publicly listed on stock exchanges. The clubs mentioned below have made their mark not only on the pitch but also in the financial world.

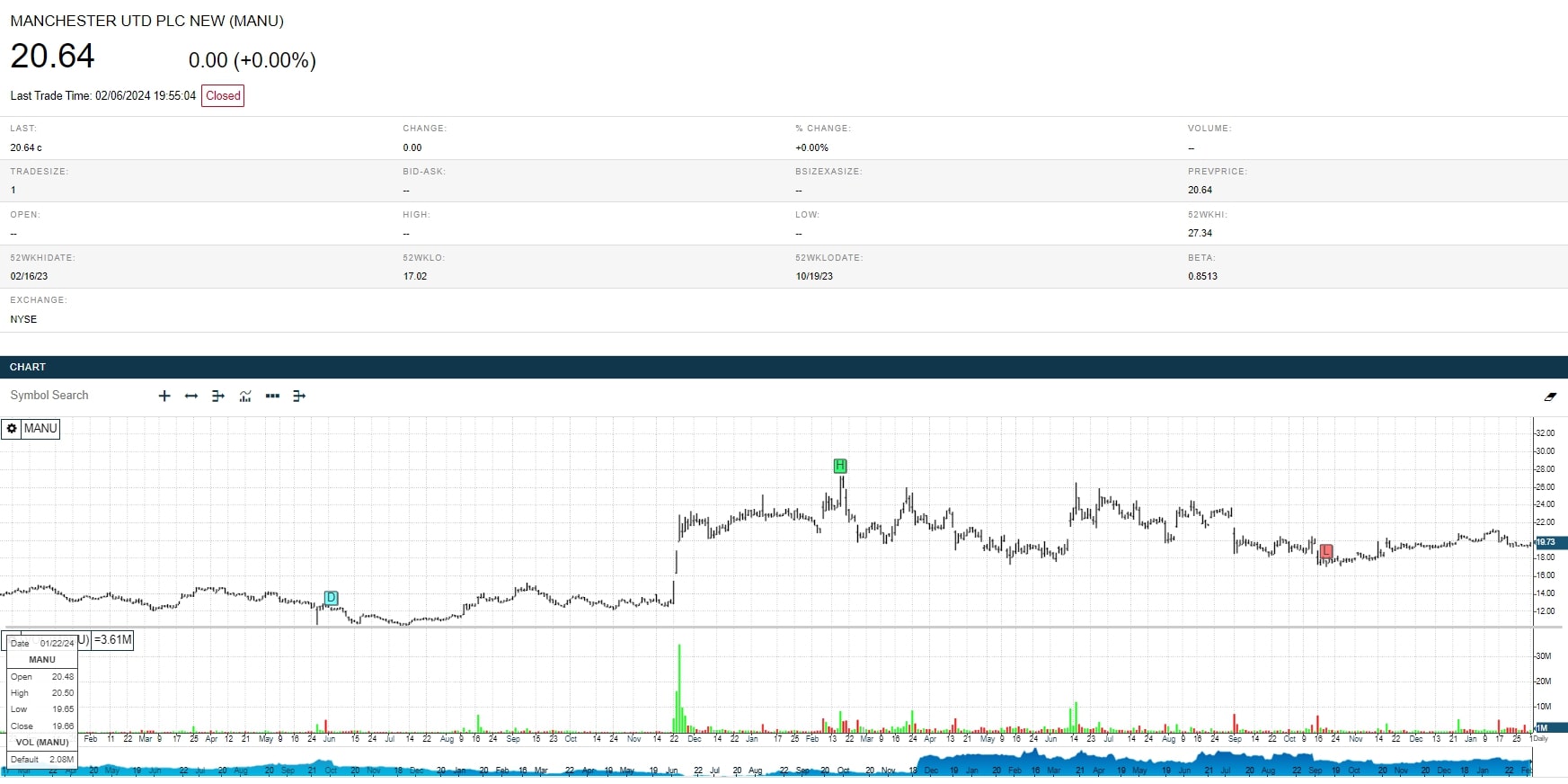

1. Manchester United PLC

-

- Exchange: New York Stock Exchange

- Ticker: MANU

As a globally recognized football club, Manchester United’s presence on the New York Stock Exchange is a testament to its financial strength and global appeal.

The club’s financial prowess, complemented by its sporting achievements and a massive global fanbase, makes it a standout on the stock market. Investing in MANU shares is like being part of a club that’s as much a global brand as it is a football team.

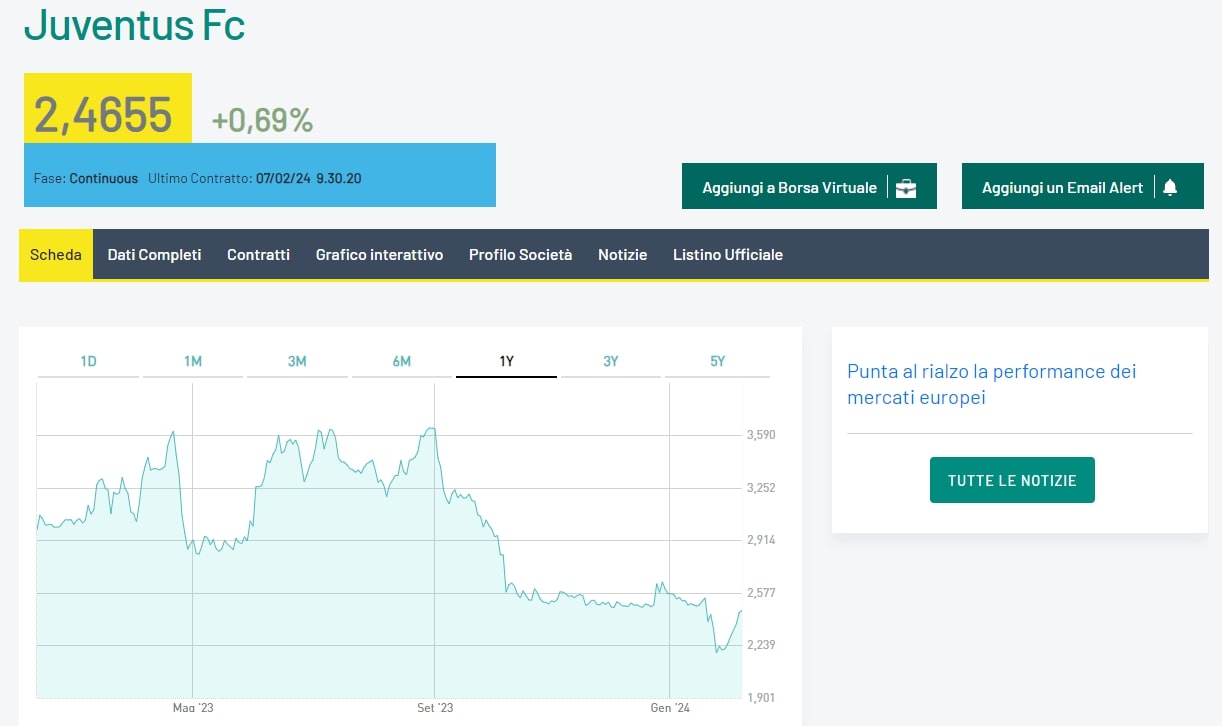

2. Juventus Football Club S.p.A.

-

- Exchange: Borsa Italiana

- Ticker: JUVE

Juventus, a titan in Italian football, offers a unique investment opportunity on the Borsa Italiana. The club’s storied history of on-field success and financial stability makes it an attractive option for investors according to the MarketScreener.

Buying shares in Juventus feels like joining a journey with a club that has a rich legacy and a strong foothold in Serie A.

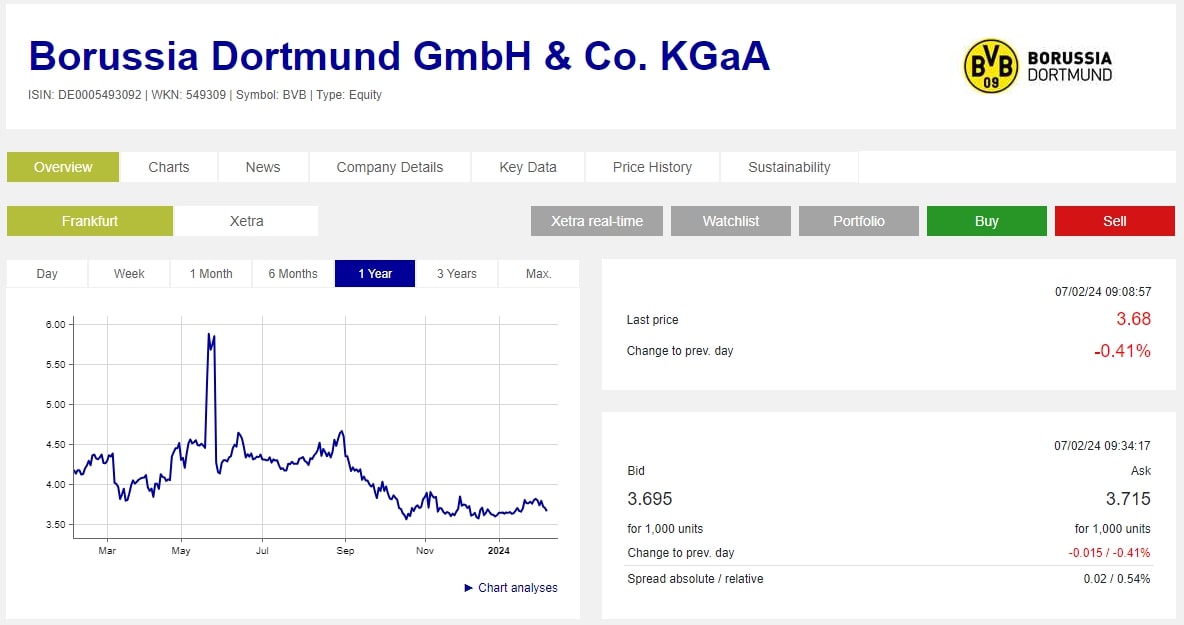

3. Borussia Dortmund GmbH & Co.

-

- Exchange: Frankfurt Stock Exchange

- Ticker: BVB

Borussia Dortmund’s distinction as the only Bundesliga club listed on the stock market is quite intriguing. Their solid financial record since listing on the Frankfurt Stock Exchange makes them an appealing choice for investors interested in German football as noted on by the Swiss Remble.

Investing in BVB shares connects me to a club known for its passionate fanbase and consistent performance.

4. Celtic PLC

-

- Exchange: London Stock Exchange

- Ticker: CCP

Celtic’s listing on the London Stock Exchange reflects a blend of tradition and modern fiscal transparency. As a shareholder of Celtic PLC, I feel part of a club with a robust sporting heritage and deep community ties.

It’s more than an investment; it’s about being part of a club with a rich history and a dedicated fanbase.

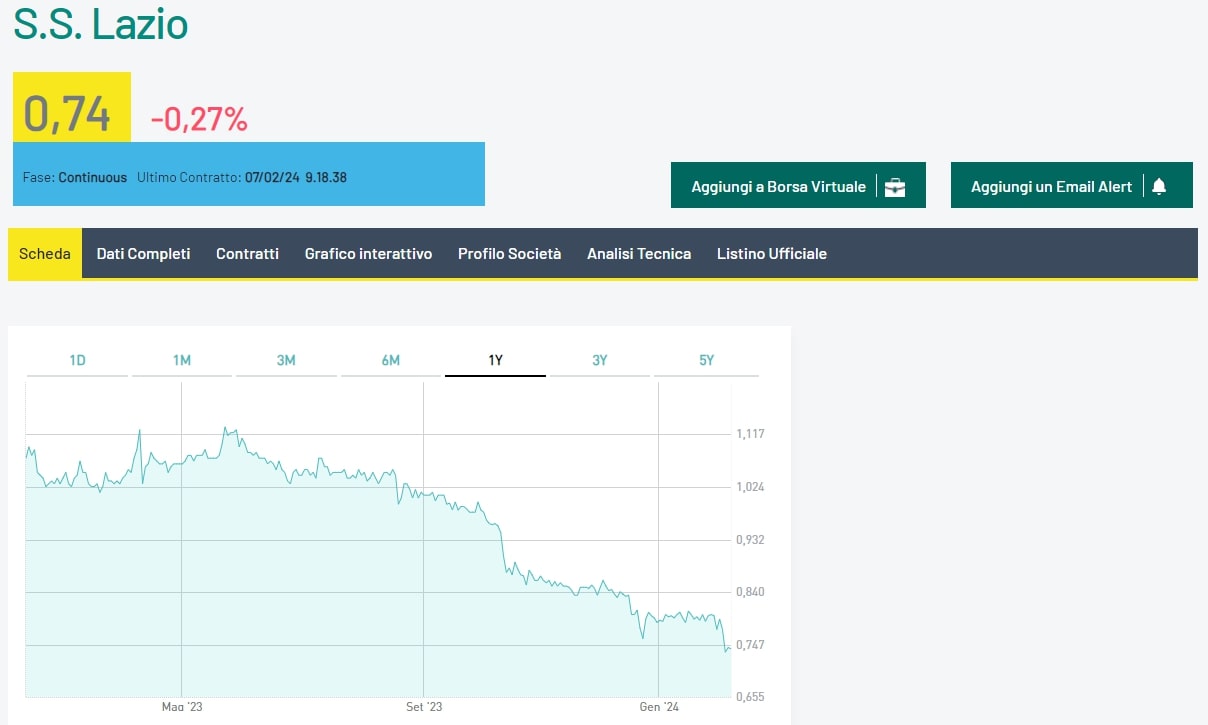

5. S.S. Lazio

-

- Exchange: Borsa Italiana

- Ticker: SSL

S.S. Lazio’s presence on the Borsa Italiana opens up investment opportunities in another of Italy’s historic football clubs as noted by Reuters.

With a dedicated fanbase and a significant role in Rome’s sporting landscape, investing in S.S. Lazio offers both a connection to Italian football culture and potential shareholder value. It’s an investment in a club that balances on-field ambition with financial growth.

6. A.S. Roma (AS Roma SPV LLC)

-

- Exchange: Borsa Italiana

- Ticker: ASR

As a fan of Italian football, I find A.S. Roma’s presence on the Borsa Italiana quite significant. The club, with its passionate fanbase and rich history in Serie A, offers an intriguing investment opportunity.

Their financial performance reflects their on-field success and cultural impact in Rome.

7. F.C. Porto (Futebol Clube do Porto)

-

- Exchange: Euronext Lisbon

- Ticker: FCP

F.C. Porto, a dominant force in Portuguese football, is listed on the Euronext Lisbon. The club’s consistent performance in domestic and European competitions makes it an attractive option for investors looking to tap into the Portuguese football market.

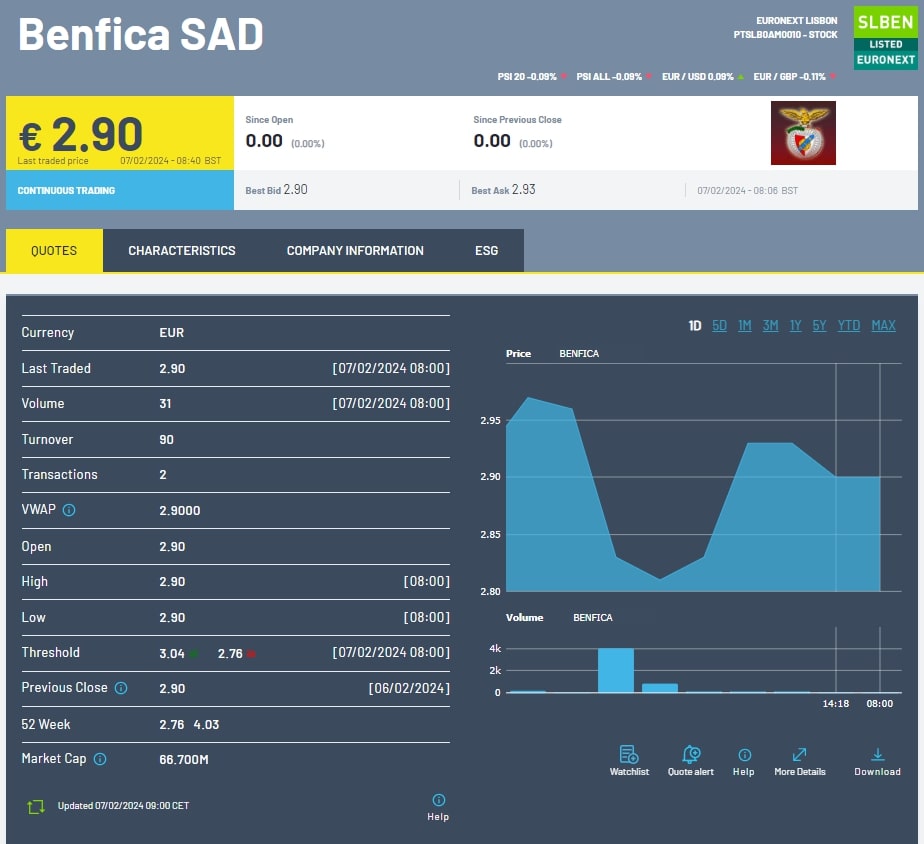

8. S.L. Benfica (Sport Lisboa e Benfica)

-

- Exchange: Euronext Lisbon

- Ticker: SLB

As a rival to F.C. Porto, S.L. Benfica’s listing on the Euronext Lisbon offers another avenue to invest in Portuguese football. The club’s strong financials and widespread popularity make it a noteworthy choice for potential investors.

9. Ajax Amsterdam (AFC Ajax NV)

-

- Exchange: Euronext Amsterdam

- Ticker: AJAX

Ajax Amsterdam, known for its rich history and youth development, trades on the Euronext Amsterdam. The club’s financial health and reputation for nurturing talent make it an appealing investment, especially for those who value long-term player development.

10. Galatasaray S.K. (Galatasaray Sportif Sinai ve Ticari Yatirimlar A.S.)

-

- Exchange: Borsa Istanbul

- Ticker: GSRAY

As Turkey’s most successful club, Galatasaray’s presence on the Borsa Istanbul is a testament to its financial and sporting prowess. The club’s strong market performance mirrors its success on the field, making it a solid choice for investors interested in Turkish football.

11. Fenerbahçe Futbol A.Ş.

-

- Exchange: Istanbul Stock Exchange

- Ticker: FENER

Fenerbahçe’s presence on the Istanbul Stock Exchange is a testament to its prominence in Turkish football. The club’s on-field performance directly impacting its share price is a fascinating aspect for an investor like me. It’s a unique way to engage with the club’s journey, blending the thrill of sports with the dynamics of the stock market.

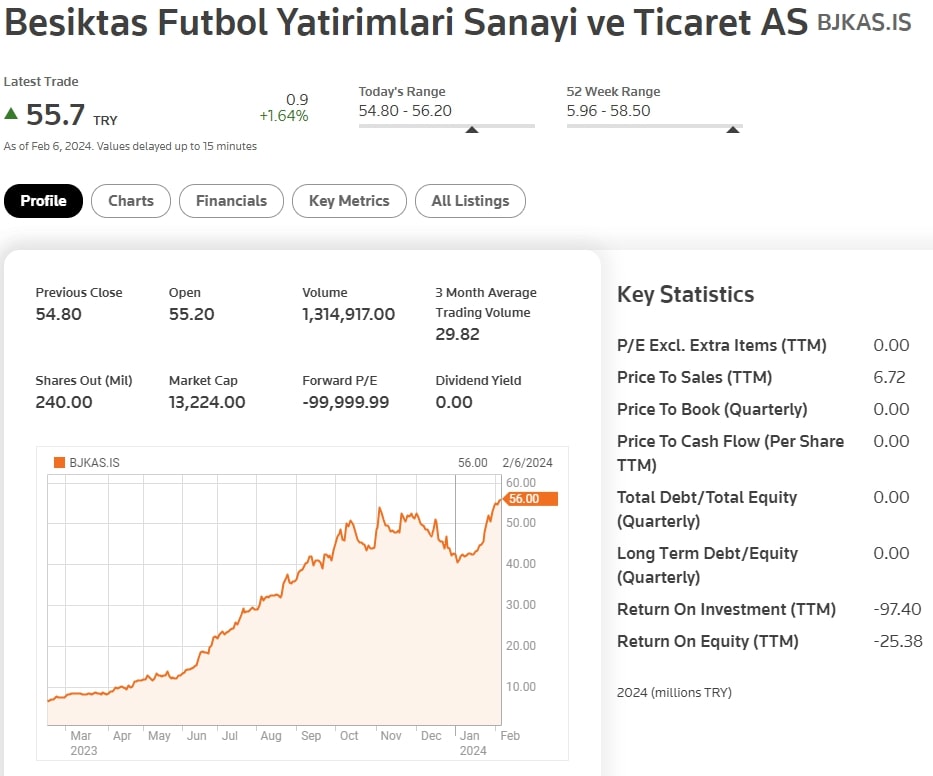

12. Besiktas Futbol Yatirimlari Sanayi ve Ticaret A.S.

-

- Exchange: Istanbul Stock Exchange

- Ticker: BJKAS

Besiktas, another major Turkish club listed on the Istanbul Stock Exchange, offers an interesting investment opportunity.

The club’s financial health and strategic decisions being influenced by its performance in leagues and tournaments make it an engaging choice for investors who are also football enthusiasts.

13. Olympique Lyonnais Groupe (Olympique Lyonnais)

-

- Exchange: Euronext Paris

- Ticker: OLG

As a fan of French football, Olympique Lyonnais’ presence on the Euronext Paris is quite exciting. Known for its strong youth academy and consistent performance in Ligue 1, the club represents a solid investment opportunity.

What draws me to Olympique Lyonnais is not just their on-field success but also their strategic approach to player development and financial management.

Financial Performance Indicators – Methodology

When assessing the financial health of listed football clubs, I focus on several key performance indicators. These indicators are crucial for investors and stakeholders when evaluating the economic stability and growth potential of these clubs.

The first indicator I consider is total revenue, which combines matchday, broadcasting, and commercial earnings. According to the Deloitte Football Money League 2024, this figure has seen significant fluctuations in recent years due to the pandemic, with a notable recovery reported in the 2021/22 season.

Another critical indicator is the asset-liability ratio, highlighting the financial leverage and risk of a club. A study published on Cell.com indicates that, in general, football clubs tend to have a high asset-liability ratio, suggesting a higher financial risk profile.

Let’s not forget about profitability which, for these clubs, is often reflected in net profits. Many clubs struggle in this area, with a significant proportion reporting losses, highlighting the volatile nature of profitability in the industry.

Liquidity is also a factor I assess, as it measures a club’s ability to meet short-term obligations without raising external capital. Liquidity issues can signify poor financial health and are common among listed football clubs.

Finally, the stock price can be an indirect reflection of both sporting and financial performance, influenced by investor sentiment and market conditions. Understanding the interplay between these factors can offer insights into the club’s broader financial health.

To sum it up, the financial performance of listed football clubs can be complex, shaped by a variety of market and internal factors that need to be closely monitored and analyzed.

Market Capitalization Trends of Football Clubs

In recent years, I’ve observed a dynamic shift in the market capitalizations of football clubs. Manchester United stands out as a prominent example with their listing on the NYSE. The club has a strong financial standing, indicative of their global brand appeal.

When examining the trends, I noted fluctuations correlated with on-field performance, broadcasting rights, and sponsorship deals. Top football clubs by market capitalization often see an appreciable increase in their value following successful campaigns both domestically and in Europe.

Here’s a brief look at the market cap trends:

- Growth Rate: A consistent growth rate is seen across publicly-listed football clubs, reflecting the burgeoning nature of the industry.

- Regional Disparities: Clubs from certain regions, like the English Premier League, exhibit higher market caps due to more lucrative TV deals.

Lastly, not all clubs are publicly traded and thus their market cap information may not be readily available. However, the ones that provide a fascinating insight into the financial side of football, reflect how significantly this sport impacts the stock market.

Revenue Streams for Publicly Traded Football Clubs

Publicly traded football clubs like Manchester United have diversified revenue sources which are crucial for their financial stability and growth according to the Academia. Here are the primary streams:

- Matchday Revenue: This includes ticket sales, hospitality, and matchday catering. With large stadiums, the earnings in this category can be significant.

- Broadcasting Rights: Clubs earn considerable income through deals with television networks for live match broadcasts.

- Commercial Partnerships: This entails sponsorship agreements and merchandising. Clubs often have deals with major brands for shirt and stadium sponsorships.

I realize that marketing revenue is crucial, too. Here’s how these clubs earn in this category:

- Merchandise Sales: The sale of jerseys, sports equipment, and memorabilia adds a stable income stream according to Goal.

- Licensing: Clubs license their brands for various products and video games, which broadens their market reach.

The international market also plays a role in revenue generation. Clubs like Juventus and Borussia Dortmund establish a global fan base which helps optimize these revenue streams.

Finally, player trading can’t be ignored. Profits from buying and selling player contracts sometimes generate significant income. However, it’s less predictable than the other streams.

Investment Risks Associated with Football Stocks

When I consider investing in football stocks, it’s crucial to be aware of the unique risks they present. Unlike typical corporate stocks, football clubs can be incredibly volatile investments due to factors like team performance, league standings, and fan sentiment. Here are the key risks:

- Volatility: Football stocks often experience sharp fluctuations based on match results or player transfers, which can rapidly affect the club’s valuation according to ResearchGate.

- Market Depth: Unlike blue-chip companies, some football clubs might trade on smaller exchanges with less liquidity. This means buying or selling large quantities can be challenging without impacting the share price.

- Financial Risks: An analysis of globally listed football clubs discloses a higher financial risk with characteristics like small listed capital and weak asset liquidity as noted by ScienceDirect.

- Profitability: Many clubs struggle to generate consistent profits, evidenced by low net profits across the industry. The reliance on intermittent income from competitions and transfers can lead to financial instability.

Here’s a quick rundown:

- Volatility: Match outcomes, managerial changes, etc.

- Liquidity: Smaller exchanges, fewer buyers/sellers

- Financial Health: Often a high asset-liability ratio

- Earnings: Club profitability can be sporadic

Investing in football stocks is akin to participating in the sport’s broader economic ecosystem. However, the potential for gains comes with considerable risk and requires due diligence and the acceptance of the possibility of dramatic shifts in investment performance.

Shareholder Structures on the Stock Market

While exploring the shareholder structures of football clubs listed on the stock market, I’ve observed several patterns. These clubs often present a mix of public and private ownership, with varying levels of shareholder concentration. Here’s a concise overview of the typical structures you may encounter:

- Majority Shareholders: Some clubs are dominated by a single entity or individual. For instance, at Manchester United, a significant proportion of shares are still held by the Glazer family, although the club is publicly listed on the New York Stock Exchange (NYSE).

- Public Shareholders: On the other hand, clubs like Juventus and Borussia Dortmund have broader shareholder distributions as per City Index. It’s worth noting that public investors can buy shares, influencing the clubs’ governance to some degree, albeit usually a small one compared to major shareholders.

- Dual-Class Share Structures: This is particularly relevant when observing clubs with a dual-class share structure, where certain shareholders might have enhanced voting rights. SS Lazio is an example where this could apply.

- Fan Ownership: A few clubs offer a small proportion of ownership to their fans, this often serves as a symbol of fans’ support rather than a significant economic stake.

Here’s a brief outline of the clubs and their respective stock listings:

- Manchester United: NYSE

- Juventus: BIT

- Borussia Dortmund: DB

- Olympique Lyonnais Groupe: EPA

By examining these shareholder structures, I’ve gained a clearer understanding of how football clubs navigate the balance between securing investment and maintaining the passion that drives the sport.

Impact of Performance on Field to Stock Prices

In my observation, the on-field performance of football clubs can have a significant effect on their stock market valuations. Take, for example, Manchester United. As one of the wealthiest sports organizations, their success or failure in domestic leagues and European competitions can sway their stock price on the NYSE. Shareholders often react to wins, losses, and draws, which can lead to fluctuations in the market value of the team according to ResearchGate.

To quantify this, consider the following points:

- On-field success: Typically leads to an increase in the club’s stock price.

- On-field struggles: Might result in a decrease in stock value.

Researchers have also drawn correlations between sporting performance and financial performance, as detailed in a Review of Behavioral Finance publication. The study found that positive field performance information and favorable financial reports tend to result in beneficial market reactions.

Additionally, the relationship between sports and financial performance has an implication on stock prices for clubs listed in European markets, as supported by research available on ResearchGate.

In my summary, performance on the field doesn’t just affect a team’s standing in the league, but it can also influence its financial stability and attractiveness to investors.

Investor Relations and Communications in Football Clubs

When I analyze the investor relations and communications strategies in football clubs, I prioritize their significance in maintaining transparency and trust between the football clubs and their stakeholders, including fans who may be shareholders. A football club’s investor relations team is tasked with conveying crucial financial data, club performance, and strategic directions to current and potential investors.

Key Components:

- Annual Reports: An insight into financial performance.

- Press Releases: Timely updates on developments.

- Investor Presentations: In-depth analysis of business strategies.

Effective Communications Channels:

- Official Websites: The primary source of up-to-date and official information.

- Shareholder Meetings: Forums for direct dialogue.

- Social Media Platforms: Engage with a wider audience, although used cautiously due to potential market sensitivity.

My emphasis on clear communication reflects the understanding that the performance of football clubs on the stock market can be as dynamic as their performance on the pitch. If the clubs are publicly listed, like Manchester United, they are under scrutiny similar to any other public company. This makes the role of investor relations even more critical as the actions on and off the field can directly affect share prices.

I also recognize the unique emotional attachment fans have with these clubs, which can lead to investor decisions driven as much by passion as by financial rationale. Here, transparency in communications becomes key to ensuring that all investors are making informed decisions, independent of their emotional ties to the club. By doing so, football clubs can foster a strong relationship with investors while adhering to market regulations and protecting the integrity of the sport and its financial stakeholders.

Regulatory Environment Governing Sports Stocks

In my exploration of the regulatory environment for sports stocks, I find that the sports teams listed on stock exchanges are subject to stringent regulation. Securities and Exchange Commission (SEC) in the United States, along with other financial authorities globally, ensure transparency and fairness in the market. As a publicly traded entity, a football club must adhere to the same financial reporting requirements as any other public company.

These organizations must provide quarterly and annual reports, detailing financial health and operations according to SEC. The intent is to protect investors, a responsibility that the regulatory bodies take seriously. Football clubs traded on stock markets such as Manchester United, Juventus, and Borussia Dortmund are obligated to disclose any information that might affect stock prices. This includes transfer deals, sponsorship agreements, and even results of significant matches, as these can impact earnings and valuations.

Any misconduct, like insider trading or manipulation of financial statements, can lead to severe penalties. These regulations ensure that I, as an investor, have access to all essential data required to make informed decisions. Additionally, stock exchanges themselves have rules on liquidity and price transparency. For instance, if I were eyeing shares of Ajax, the Amsterdam Stock Exchange would require the club to meet market-specific listing criteria and standards for continued trading.

Moreover, I must consider the impact of regional regulations. For instance, the rules for a football club listed on the BIT in Italy might be differences from those on the NYSE.

Frequently Asked Questions

In this section, I’ll address some common inquiries about investing in football clubs through the stock market as of 2024, providing specifics on various clubs that have publicly traded shares, their share prices, and the associated investment risks.

How can I invest in football clubs through the stock market?

To invest in football clubs on the stock market, purchase shares through a brokerage account, just as you would with any other publicly traded company. Clubs like Manchester United are listed on major exchanges such as the NYSE.

Which Premier League clubs have publicly traded shares as of 2024?

As of 2024, Manchester United is a prominent Premier League club with publicly traded shares, listed on the New York Stock Exchange.

What are the share prices of major publicly traded football clubs?

Share prices for publicly traded football clubs vary and are subject to market fluctuations. Borussia Dortmund, for example, has seen shares trading below €8 since 2020, with a noticeable decline to below €4 in 2024.

Can you list European football clubs that are available for public investment in 2024?

European football clubs available for public investment include Juventus, AS Roma, Borussia Dortmund, and Celtic, among others, each with shares traded on various stock exchanges.

Which publicly traded football club has the highest market capitalization?

As of my last update, Manchester United has been one of the football clubs with the highest market capitalization, reflecting its significant global brand and extensive fan base.

Are there any significant risks involved in investing in football clubs on the stock market?

Investing in football clubs on the stock market carries risks similar to any equity investment, such as market volatility and performance-related issues. Football clubs’ valuations can be influenced by on-field results and management decisions.

Final Words

Exploring the world of football clubs on the stock market has been a fascinating journey. It’s a realm where the passion of sports meets the pragmatism of finance, offering unique opportunities for fans and investors alike. The blend of emotional and financial investment in these clubs is unparalleled in any other sector.