In times when living costs are on the rise, it’s essential to use clever shopping tactics both in stores and online to make sure your budget goes further.

This strategy means actively avoiding impulse purchases and instead spending on things that are more about long-term benefit than immediate gratification.

By choosing what you really need over what you simply want, you can protect your money while still maintaining a good quality of life, Offermate can help you just with that!

Key Takeaways

- Cut unnecessary expenses.

- Use lists and coupons, and buy in bulk.

- Brew coffee, and use cash-back cards.

- Have clear, realistic savings targets.

- Choose no-fee banking options.

11 Tips For Your Budget

1. Look at Your Spending

Check where your money goes each month. Can you find areas to cut back? For instance, if you’re buying lunch outside every day, think about reducing it to a few times a week.

Making small changes like this can help you save money in your budget.

2. Prepare a Shopping List

To avoid overspending on things you don’t need, create a shopping list before you go out.

This keeps you on track to buy only what you need, helping to prevent impulse buys.

3. Check Prices Before Buying

Always compare prices before making a purchase.

You might discover the same item is cheaper elsewhere or find a less expensive alternative to what you originally planned to buy.

4. Use Your Coupons

Start by collecting coupons from different places to make sure you’re getting the best deals out there. Look in local newspapers, store newsletters, and websites for the latest discounts.

Concentrate on getting coupons for things you already buy to avoid spending money on items you don’t need, just because they’re on sale dude.

5. Cut Back on Non-Essential Spending

Everyone has essential expenses such as food and housing. We often spend money on things we don’t need, like frequent meals out or new clothes when our closets are already full.

By reducing these types of expenditures, you can save a significant amount of money.

6. Set Your Savings Goals

It’s important to establish clear financial goals for each month. This approach turns budgeting into a goal-oriented process, whether it’s accumulating an emergency fund or saving for a big purchase.

By applying the S.M.A.R.T. criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—to your financial objectives, you create a practical plan that not only keeps you focused but also motivated to save.

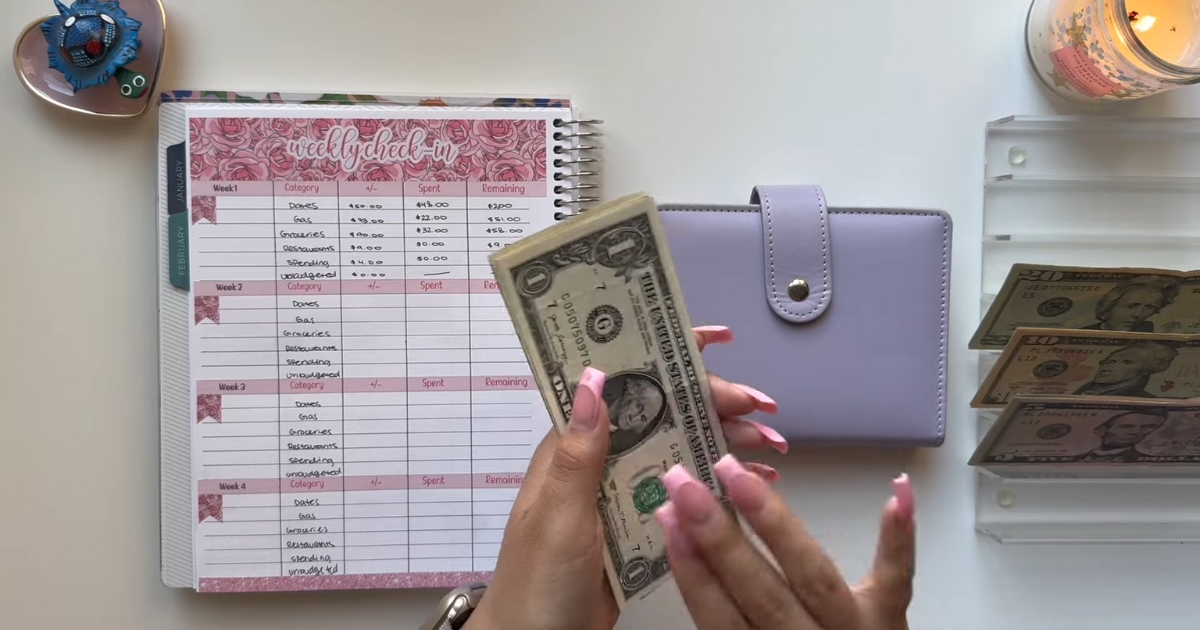

7. Distribute Your Income Wisely

Once you’ve set your savings goals, the next step is to organize your monthly income to cover all your expenses while still meeting your savings targets. The 50/30/20 budgeting rule is a useful framework here, dividing your income between needs, wants, and savings or debt repayment.

Always prioritize essential expenses first. After that, you can allot money for personal desires and then set aside funds for savings and paying off any debts. Regularly adjusting how you allocate your money is crucial for dealing with financial shifts and keeping your savings strategy on track.

8. Take Advantage of Seasonal and Bulk Purchases

Buying fruits and vegetables when they’re in season can save you money and provide better-tasting produce. Check local seasonal guides to plan your meals around what’s currently abundant.

Also, buying items in bulk, especially those that don’t spoil quickly or things you use often, can significantly reduce your expenses. Remember to compare prices by the unit to make sure you’re getting a good deal. Keep an eye out for coupons and discounts to stretch your grocery budget even further.

9. Make Coffee at Home

Spending $2.50 to $4 daily on coffee from a cafe can add up to $625 to $1,000 a year. This calculation doesn’t even cover more expensive drinks like lattes. However, purchasing a pound of quality coffee for about $15, which makes at least 30 cups, reduces your cost significantly.

By brewing your coffee at home, your annual expense drops to roughly $125. This change can save you between $500 to $875 yearly, and over $45,000 across a lifetime, not a small amount huh?

10. Use a Cash-Back Credit Card for Everything

Take full advantage of credit cards that offer cash-back rewards by using them for all possible everyday expenses: groceries, fuel, bills, dining out, and anything else you regularly pay for. Just ensure you pay off the entire balance each month to avoid interest charges, which can negate the benefits of any rewards earned.

For instance, if a family puts $2,000 monthly on a card like the Capital One Quicksilver Rewards Card, which offers 1.5% back on purchases, they’d earn $30 monthly. Over 25 years, this adds up to around $19,000 yea, shockingly. Cards like the Citi DoubleCash offer 2% back, potentially increasing savings even more.

11. Reduce Bank Fees

Take a closer look at your bank account statements and you might be shocked by the fees you’re paying for some stuff.

To cut down on these fees, use only ATMs that don’t charge you, make sure you have enough money in your account to cover checks to avoid overdraft fees, and use credit cards or free peer-to-peer payment apps like Venmo instead of withdrawing cash.

If you’re still getting hit with high fees, think about switching banks. If your current bank isn’t helping you lower your fees, an online bank could be a good alternative. They usually don’t charge monthly maintenance fees or require a minimum balance, and they often offer higher interest rates on savings and CDs.

Community banks and credit unions can be another option too. They offer many of the same benefits as online banks, like lower fees and higher interest rates, with the bonus of in-person service.

Bottom Line

In short, smart money management is all about simple steps and smart choices. Keeping an eye on your daily expenses, shopping with a plan, and leveraging financial tools like cash-back credit cards can boost your savings.

Small habits, like making coffee at home, can lead to big savings over time. Set clear goals, minimize fees, and remember, every little bit helps. Stick with it, and you’ll see your savings pile up. It’s rewarding to watch your financial savvy pay off, so let’s get started on this journey together!