Navigating the labyrinth of credit scores can be a daunting task. The reality is that even the smallest of actions can have a significant impact on your score. FICO credit scores, the most commonly used by lenders, range from 300 to 850 and are calculated based on your report.

This includes your payment history, the amount you owe, the length of your credit history, the types you have, and the number of new accounts you have. There are numerous ways you can inadvertently damage your score.

“There’s a multitude of things you could be doing wrong. Most of the time, the people who come to me don’t even realize what they’ve done wrong.” Whether you’re looking to boost your credit score or rectify past credit issues, being aware of potential pitfalls can help you avoid damaging your score.

1. Ignoring Your Credit Report

“Out of sight, out of mind” might seem like a blissful approach, but it can lead to a rude awakening when you’re looking to make a significant purchase like a home or car, or even rent an apartment.

How to avoid it: This is a simple mistake to avoid. Regularly checking your credit score can alert you to any fraudulent activity linked to your name, provide you with your score, and highlight any areas that need attention.

How to fix it: If you’ve been neglecting to check your credit score, start today. It’s as simple as visiting CreditReport.com.

2. Habitual Late Bill Payments

Your payment history plays a crucial role in your credit score. A single late payment can potentially lower your score by 100 points or more.

However, if you act quickly, you can mitigate the damage. While a few days late won’t jeopardize your score, consistently paying bills 30 or more days late can have a severe impact on your credit.

How to avoid it: Do whatever it takes to avoid late payments. Set up reminders if you’re forgetful or tighten your budget if you’re overspending.

How to fix it: If you’ve made a late payment, contact your lender to understand their policy on reporting late payments. If the late payment has already been reported, you might not be able to remove it from your credit report. The best course of action is to ensure all future payments are made on time.

3. Owning Too Many Credit Cards

Having a plethora of credit cards, even if you pay them off each month, can be problematic. “Having too many cards can negatively impact both your credit score and your ability to borrow money,” warns Julie Pukas, the former head of commercial product integration at TD Bank.

Even if you don’t max out all your cards, lenders might worry about what would happen if you did.

How to avoid it: “Having three to five credit cards is usually not a problem,” Pukas advises. “But if you find your credit card balances are increasing, that’s a danger signal.” She recommends limiting the amount of available credit you have at any one time.

How to fix it: If your utilization ratio gets too high, consider closing one of your newer credit accounts to keep your utilization ratio low and your history long.

4. Carrying High Balances on Your Credit Cards

After payment history, the amount you owe is the second most important factor in your credit score, according to myFICO, the consumer division of FICO.

Owing money doesn’t necessarily lower your score, but using ahigh percentage of your available credit can. A high utilization ratio can hurt your credit score and make lenders view you as a high-risk borrower. Consumers with the best scores use 10% or less of their available credit, says Kelly.

How to avoid it: “There is no absolute ‘right’ answer to how much of your credit limit you should be utilizing,” Pukas says. “What’s more important to note is that, if you’re carrying balances on credit cards that exceed 50% of the available credit, then you’re hurting your credit score.”

How to fix it: “Strive to get your total utilization under 50% first and then keep going,” Pukas advises. “This is one of the fastest ways to increase your credit score.”

5. Not Having Any Credit Cards

While it might seem counterintuitive, not having any credit cards can actually hurt your credit score as much as having too many. Lenders like to see a long history of responsible use, and if you don’t have a card, you might not have much information to show.

How to avoid it: If you don’t want to open your own credit card account, consider asking a friend or family member to add you as an authorized user. You won’t have to use the card for it to benefit your credit score — you’ll simply piggyback off the good habits of someone else.

How to fix it: Becoming an authorized user on someone else’s card can also help you repair mistakes. Just make sure the person who adds you to a credit account is a responsible borrower. After all, their bad borrowing behavior can also show up on your report.

6. Closing Old or Inactive Credit Cards

While it’s smart to limit the number of credit cards you have at any given time, Pukas notes that closing old or inactive cards can come back to haunt your score. “The length of your history affects 15% of your score,” she says. “This is why it’s important not to close credit card accounts that you have had for years.”

How to avoid it: Strive to keep older credit cards active by using them sparingly — once every few months — and paying off the balances on time.

How to fix it: If you don’t trust yourself not to rack up debt on those cards, “consider canceling newer accounts rather than old ones, so that the length of your credit history is not impacted,” Pukas advises.

7. Requesting a Higher Credit Limit

Even though your credit card issuer checked your credit when you applied for your card, it will likely check it again if you ask for a higher limit. This could be reported as an inquiry, which could affect your score, says Gerri Detweiler, a expert and former education director for Nav, which helps business owners manage their credit.

How to avoid it: If at all possible, try to spend well within your current limit. That way, you won’t put your credit at risk.

How to fix it: This doesn’t mean you shouldn’t ask for a higher limit — especially if you’re responsible with credit and don’t plan to charge your card to the max. But you should think twice about doing so before applying for a mortgage or other loan.

8. Consolidating Debt Onto One Card

If you owe money on several credit cards, you might be tempted to consolidate debt by transferring all the balances to one new card. But that can be a mistake. Not only can this lower the average age of your credit history, especially if you choose to close out the other cards, but it can also increase your debt-to- ratio.

How to avoid it: Before you consolidate, consider the potential impact on your credit score. If you’re not careful, you could end up hurting your credit score more than helping it.

How to fix it: If you’ve already consolidated your debt onto one card, consider opening a new credit card to help lower your utilization ratio. Just remember to use this card responsibly and pay off the balance each month.

9. Applying for Multiple Credit Cards at Once

When you apply for a credit card, the lender will perform a hard inquiry on your credit report to determine your creditworthiness. If you apply for several cards within a short period of time, these hard inquiries can add up and negatively impact your credit score.

How to avoid it: Limit your credit card applications to only when necessary. If you’re shopping for a specific type of loan, try to do so within a short period of time to minimize the impact on your credit score.

How to fix it: If you’ve already applied for multiple credit cards, the best thing you can do is wait. Hard inquiries will fall off your report after two years.

10. Co-Signing a Loan

Co-signing a loan can be a kind gesture to help a friend or family member, but it can also put your credit at risk. If the person you co-signed for misses a payment or defaults on the loan, it can negatively impact your credit score.

How to avoid it: Think twice before co-signing a loan. If you do decide to co-sign, make sure you trust the person to make their payments on time.

How to fix it: If you’ve already co-signed a loan and the other person has missed payments, the best thing you can do is make the payments yourself to prevent further damage to your credit score.

11. Not Diversifying Your Credit

Lenders like to see a mix of different types of credit on your report. If all your credit comes from credit cards, it might not look as good as if you also have a mortgage, a car loan, or a student loan.

How to avoid it: Try to diversify your portfolio. This doesn’t mean taking on debt you don’t need, but rather considering different types of when necessary.

How to fix it: If you lack diversity in your portfolio, consider opening a different type of credit account. Just remember to manage this new responsibly.

12. Filing for Bankruptcy

Filing for bankruptcy can have a devastating impact on your credit score and it can take years to recover. It’s a last resort option that should only be considered when all other options have been exhausted.

How to avoid it: Try to manage your debts responsibly and seek help if you’re struggling. There are many non-profit organizations that offer free credit counseling.

How to fix it: If you’ve already filed for bankruptcy, focus on rebuilding your credit. This can include paying all your bills on time, keeping your credit balances low, and adding new credit only when necessary.

13. Ignoring Your Student Loans

Student loans are a type of installment loan, and like other loans, not paying them can hurt your credit score. Even if you’re struggling financially, there are usually options available to you, such as income-driven repayment plans or deferment.

How to avoid it: Stay in contact with your loan servicer and make sure you understand your repayment options.

How to fix it: If you’ve missed payments on your student loans, contact your loan servicer immediately. They can help you understand your options and get back on track.

14. Not Using Your Credit Cards

While it’s good to avoid carrying high balances on your cards, not using your credit cards at all can also hurt your score. Lenders like to see activity on your accounts.

How to avoid it: Use your credit cards regularly, but make sure to pay off the balance each month.

How to fix it: If you haven’t been using your cards, start incorporating them into your budget. Remember to pay off the balance each month to avoid interest charges.

15. Maxing Out Your Credit Cards

Maxing out your credit cards can significantly increase your utilization ratio, which can hurt your score. Lenders may view this as a sign that you’re relying too heavily on credit.

How to avoid it: Try to keep your credit card balances low. A good rule of thumb is to use no more than 30% of your available credit.

How to fix it: If you’ve maxed out your cards, focus on paying down your balances. Consider using a budgeting app to help manage your spending.

16. Paying Only the Minimum Due on Your Credit Cards

While paying the minimum due on your credit cards will keep your account in good standing, it won’t help you reduce your debt or lower your utilization ratio.

How to avoid it: Try to pay more than the minimum due each month. Even a little extra can make a big difference over time.

How to fix it: If you’ve been only paying the minimum, start paying more each month. Even a small increase can help reduce your debt faster.

17. Having an Account Sent to Collections

Having an account sent to collections can significantly hurt your credit score. This can happen if you fail to pay a bill and the company sells your debt to a collections agency.

How to avoid it: Pay all your bills on time. If you’re struggling to make payments, contact the company to seeif they can work out a payment plan with you.

How to fix it: If you’ve had an account sent to collections, pay off the debt as soon as possible. Then, focus on rebuilding your credit by making all future payments on time.

18. Taking Out Cash Advances

Taking out a cash advance on your credit card can be a costly mistake. Not only do cash advances usually come with high interest rates and fees, but they can also signal to lenders that you’re having financial difficulties.

How to avoid it: Avoid using your credit card for cash advances. If you need cash in a hurry, consider other options like a personal loan or borrowing from friends or family.

How to fix it: If you’ve taken out a cash advance, pay it off as quickly as possible to minimize interest charges. Then, try to build up an emergency fund so you won’t need to rely on cash advances in the future.

19. Not Checking Your Credit Report for Errors

Errors on your report can lower your credit score. These can range from incorrect personal information to fraudulent accounts opened in your name.

How to avoid it: Regularly check your report for errors. You’re entitled to a free report from each of the three major credit bureaus every year through AnnualCreditReport.com.

How to fix it: If you find an error on your report, dispute it with the credit bureau. They are required by law to investigate and correct any errors.

20. Not Having a Budget

Not having a budget can lead to overspending, which can result in high credit card balances and missed payments.

How to avoid it: Create a budget and stick to it. There are many free budgeting apps available that can help you track your spending and save money.

How to fix it: If you don’t have a budget, start one today. It’s never too late to start managing your money more effectively.

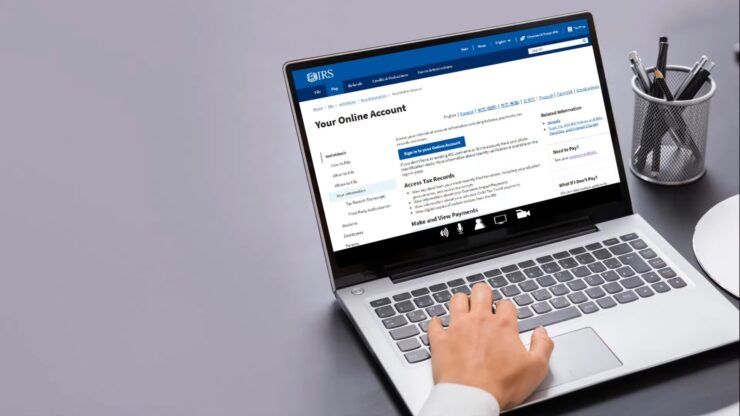

21. Not Paying Your Taxes

Failing to pay your taxes can lead to a tax lien, which can significantly lower your credit score. Even if you can’t afford to pay your taxes in full, the IRS offers payment plans and other options.

How to avoid it: File and pay your taxes on time. If you can’t afford to pay in full, contact the IRS to discuss your options.

How to fix it: If you owe back taxes, contact the IRS to arrange a payment plan. Once you’ve paid off your debt, your credit score should start to improve.

22. Not Having Any Credit

Having no credit can be just as bad as having bad credit. Without a credit history, lenders have no way of knowing if you’re a responsible borrower.

How to avoid it: Start building as soon as possible. You can do this by getting a credit card, taking out a small loan, or becoming an authorized user on someone else’s card.

How to fix it: If you don’t have any credit, start building it today. Remember to make all your payments on time and keep your credit balances low.

23. Defaulting on a Loan

Defaulting on a loan can have a severe impact on your credit score. This can happen if you fail to make your loan payments for a certain period of time.

How to avoid it: Make all your loan payments on time. If you’re struggling to make payments, contact your lender to discuss your options.

How to fix it: If you’ve defaulted on a loan, contact your lender to see if they can work out a repayment plan with you. Once you’re back on track, your credit score should start to improve.

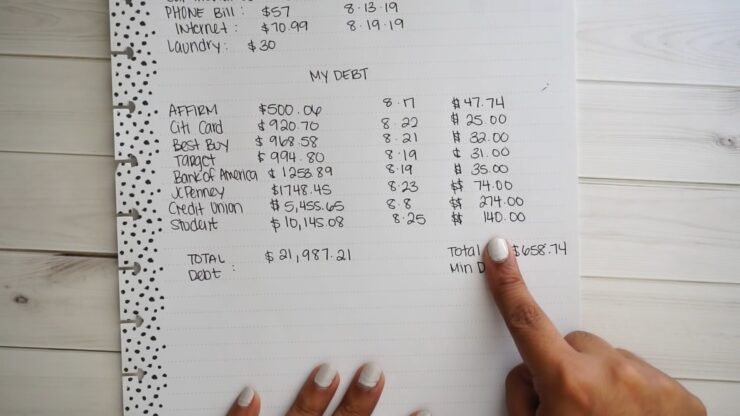

24. Having a High Debt-to-Income Ratio

Your debt-to-income ratio is the amount of your monthly income that goes towards paying your debts. A high debt-to-income ratio can make it difficult to get approved for new credit.

How to avoid it: Try to keep your debts low and your income high. If you’re considering taking on more debt, make sure it won’t significantly increase your debt-to-income ratio.

How to fix it: If your debt-to-income ratio is high, focus on paying down your debts and increasing your income. This could involve getting a second job, asking for a raise, or finding ways to cut back on your expenses.

25. Ignoring Your Credit Score

Your credit score is a reflection of your financial health. Ignoring it can lead to unpleasant surprises when you need to apply for credit.

How to avoid it: Regularly check your score. Many banks and credit card issuers offer free score access to their customers.

How to fix it: If you’ve been ignoring your credit score, start paying attention to it. Regularly check your score, dispute any errors on your credit report, and take steps to improve your health.

FAQ

What is a credit score and why is it important?

A credit score is a numerical representation of your creditworthiness, based on your credit history. It’s used by lenders to assess the risk associated with lending you money. A higher score indicates that you’re a lower risk, which can make it easier to get approved and secure lower interest rates.

How can I improve my credit score?

Improving your credit score involves a combination of responsible financial behaviors. This includes paying your bills on time, keeping your card balances low, not applying for new credit too frequently, and maintaining a mix of credit types. Regularly checking your report for errors and disputing any inaccuracies can also help improve your score.

How does late bill payment affect my credit score?

Late bill payments can have a significant negative impact on your credit score. Your payment history is a major factor in your score calculation, and even a single late payment can potentially lower your score by 100 points or more. Consistently paying bills 30 or more days late can have a severe impact on your credit.

How many credit cards should I have?

The optimal number of credit cards can vary from person to person, but having three to five credit cards is usually not a problem. However, having too many cards, even if you pay them off each month, can negatively impact your credit score and your ability to borrow money.

How does bankruptcy affect my score?

Filing for bankruptcy can have a devastating impact on your credit score, and it can take years to recover. It’s a last resort option that should only be considered when all other options have been exhausted.

How does co-signing a loan affect my credit score?

Co-signing a loan can put your risk. If the person you co-signed for misses a payment or defaults on the loan, it can negatively impact your credit score.

How does my debt-to-income ratio affect my credit score?

Your debt-to-income ratio is the amount of your monthly income that goes towards paying your debts. A high debt-to-income ratio can make it difficult to get approved for new credit.

How does not having any credit affect my score?

Having no credit can be just as bad as having bad credit. Without a credit history, lenders have no way of knowing if you’re a responsible borrower. It’s important to start building as soon as possible.

How does maxing out my credit cards affect my score?

Maxing out your cards can significantly increase your utilization ratio, which can hurt your score. Lenders may view this as a sign that you’re relying too heavily on credit.

How does not paying my taxes affect me?

Failing to pay your taxes can lead to a tax lien, which can significantly lower your credit score. Even if you can’t afford to pay your taxes in full, the IRS offers payment plans and other options.