The global economy is navigating a complex transition phase, marked by the aftermath of the pandemic-induced economic downturn and the geopolitical tensions arising from Russia’s conflict with Ukraine. The supply chain disruptions that plagued businesses worldwide are gradually easing, and there are signs of economic recovery.

Central banks’ monetary policies are anticipated to yield results, with inflation rates expected to realign with targets. The year 2024 is seen as a turning point, with the global economy projected to regain stability. The International Monetary Fund’s (IMF) World Economic Outlook for July 2024 forecasts a modest global growth rate of 3% for both 2024 and 2024, a slight dip from the 3.5% estimated for 2022.

The report also predicts a gradual decrease in global inflation, albeit slower than initially expected, from 8.7% in 2022 to 6.8% in 2024. The core inflation rate, however, is expected to remain moderate, with an upward revision for the 2024 forecast.

The primary drivers behind these trends are the lingering effects of the COVID-19 pandemic and the trade tensions triggered by the Russia-Ukraine conflict. The IMF briefing on the World Economic Outlook for July 2024 offered a cautiously optimistic view of the global economy.

It acknowledged the resilience of economic activity in the first quarter, the easing of supply chain disruptions, and the containment of financial instability following the March banking turmoil. However, it also highlighted the challenges of low growth rates, contractionary interest rates, and persistent core inflation.

The briefing underscored the importance of labor market dynamics and wage-profit relationships in the ongoing battle against inflation. Looking ahead, the economic growth of developed economies is expected to decelerate, with a projected drop from 2.7% in 2022 to 1.5% in 2024.

In contrast, developing economies and emerging markets are predicted to maintain stable growth rates of 4% in 2024 and 4.1% in 2024. The World Economic Forum’s Chief Economists’ Outlook paints a somewhat somber picture of the global economy, with chief economists forecasting moderate to strong growth primarily in the Middle East, North Africa, and South Asia.

Key economies in these regions, including Saudi Arabia, the United Arab Emirates, India, and Japan, are expected to play a significant role in the global economic landscape.

How are Businesses Recovering?

The business landscape in 2024 is a mixed bag, with recovery trajectories varying across sectors. Healthcare, energy, and utilities have been underperforming, with Pfizer Inc. (NYSE:PFE) seeing a significant 30% drop in shares since the beginning of the year.

In contrast, the technology and consumer discretionary sectors are thriving, with investors favoring tech stocks despite high inflation concerns. The surge in the tech sector is largely attributed to the growing interest in artificial intelligence (AI), with Alphabet Inc. (NASDAQ:GOOG)’s Google leading the charge.

Google’s robust progress in AI and cloud services has piqued customer interest, and CEO Sundar Pichai is optimistic about AI’s potential to expand Google’s total addressable market and attract new customers. Google’s AI endeavors face competition from tech giants like Microsoft Corporation (NASDAQ:MSFT), Meta Platforms, Inc. (NASDAQ:META), and Amazon.com, Inc. (NASDAQ:AMZN).

Alphabet Inc. (NASDAQ:GOOGL) reported impressive Q2 2024 earnings, with earnings per share of $1.44 surpassing expectations by $0.10, and revenue of $74.60 billion exceeding consensus by $1.85 billion. The company’s ongoing advancements in cloud business and AI have fueled a 10% surge in its stock this week.

The launch of the Search Generative Experience (SGE) marks a significant evolution in search, making it more natural and intuitive. The company’s focus on efficiency and alignment with high-priority efforts is evident in its reallocation of teams and optimization of its real estate footprint.

Google Cloud continues to grow, with Q2 revenue of $8 billion, up 28%, and an operating profit of $395 million. The platform’s AI-optimized infrastructure is a preferred choice for training and serving generative AI models.

The company’s new generative AI offerings are expanding its total addressable market and attracting new customers. In the tech stock market, hedge funds favor Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN), Meta Platforms, Inc. (NASDAQ:META), and Alphabet Inc. (NASDAQ:GOOGL).

These companies are poised to shape the future of the tech sector and continue to offer promising investment opportunities.

Most Struggling Economies

In the realm of global economics, some nations find themselves grappling with a myriad of challenges that hinder their growth and stability.

20. Austria

Austria’s GDP, which strongly rebounded in 2022, is projected to fall by -0.3% in the first quarter of 2024. This is due to a substantial drop in the export of goods and an increase in energy prices.

19. Puerto Rico

Being a U.S. territory, Puerto Rico is dealing with the ramifications of lost federal tax provisions and massive debt. Natural disasters and governmental mismanagement have compounded the territory’s economic woes.

Puerto Rico, with a GDP of $120.84 billion, ranks amongst the worst-performing economies in 2024.

18. Latvia

Inflation and delays in public investment programs have put the Latvian economy in a challenging situation. With a GDP of $47.4 billion, Latvia is the 18th worst-performing economy in 2024.

17. Poland

Poland is reeling from the aftermath of the Russia-Ukraine conflict. High inflation rates have dampened personal incomes and private consumption is projected to decline in 2024.

With a GDP of $748.89 billion, Poland is the 16th worst-performing economy in 2024.

16. Haiti

Political instability and rising violence have undermined Haiti’s economy. The nation’s social and economic development continues to be compromised due to growing social insecurity and susceptibility to natural disasters.

Haiti, with a GDP of $26.58 billion, joins the list of the worst-performing economies in 2024.

15. Argentina

Argentina is battling one of its worst economic crises, with stringent import controls impacting the economy. Inflation rates are skyrocketing, further stressing the already vulnerable economy.

As one of Latin America’s largest economies with a GDP of $641.1 billion, Argentina is amongst the worst-performing economies in 2024.

14. South Africa

High public debt levels in South Africa have curtailed government action against economic shocks and obstructed the fulfillment of social and development needs. The COVID-19 pandemic has further amplified the country’s socio-economic challenges.

South Africa, with a GDP of $399.02 billion, ranks 14th on the list of the worst economies in 2024.

13. Denmark

Denmark is gradually recovering from the post-pandemic economic slump. As consumer confidence improves, private consumption is expected to rebound.

With a GDP of $405.63 billion, Denmark is among the worst-performing economies in 2024.

12. Finland

Finland is seeing stagnant economic growth due to weak business and consumer confidence. In 2024, high inflation and tough financing conditions are expected to severely impact consumption.

With a GDP of $301.67 billion, Finland is the 12th worst-performing economy in 2024.

11. Germany

Germany, one of Europe’s largest economies, is stagnating and technically entering a recession. In July, KPMG provided economic forecasts for Germany for 2024, ranging from -0.5% to +0.4%.

With a GDP of $4.31 trillion, Germany is one of the worst-performing economies in 2024.

10. United Kingdom

The United Kingdom, one of the world’s major powers, is facing significant economic challenges. High gas prices, rising interest rates, and stagnant trade activities have led to an economic downturn.

With a GDP of $3.16 trillion, the UK is amongst the worst-performing economies in 2024.

9. Lithuania

Lithuania, like many European economies, has been affected by Russia’s invasion of Ukraine. Economic activity is being strained due to a reduction in private consumption, and supply chain disruptions have caused input prices to rise.

Lithuania, with a GDP of $78.35 billion, is the ninth-worst-performing economy in 2024.

8. Sweden

The Swedish economy is expected to decelerate due to increasing energy prices and interest rates, which are negatively impacting domestic demand. With a GDP of $599.05 billion, Sweden ranks among the worst-performing economies in 2024.

7. Czech Republic

After a moderate economic performance in 2022, the Czech Republic is on a downward trajectory. The economy is contracting due to increased price pressures and tight domestic financial conditions.

The Czech Republic, with a GDP of $330.48 billion, is the seventh worst-performing economy in 2024.

6. Yemen

Yemen, one of the Middle East’s struggling economies, faces long-term economic hurdles. The country has experienced significant infrastructural damages due to a decade-long war.

Yemen, with a GDP of $19.53 billion, is the sixth worst-performing economy in 2024.

5. Chile

Chile’s economy is facing a downward trajectory with its economic adjustment expected to continue slow growth in 2024. The government’s contractionary policies have caused a drop in consumption, weakened labor markets, and depleted household liquidity.

Chile has a GDP of $358.56 billion and ranks fifth on our list of the worst-performing economies in 2024.

4. Estonia

Estonia is one of the worst-performing economies as the country’s weak private consumption amid high inflation continues to harm the economy. Estonia has a GDP of $41.55 billion, supported by limited exports and fragile growth in trade partner economies.

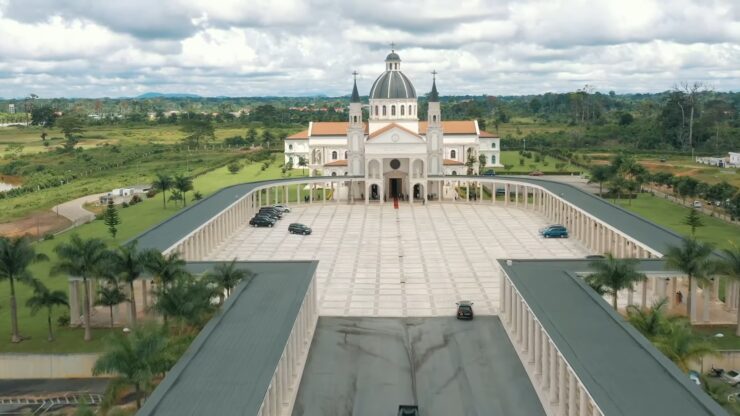

3. Equatorial Guinea

An upper middle-income country, Equatorial Guinea faced a recession for almost seven years. The country has a GDP of $15.1 billion and ranks third on our list of the worst economies in 2024.

2. Ukraine

Ukraine has been trapped in a massive war against Russia which has far-reaching economic and human impacts. The country has been relying on foreign aid to survive a struggling economy during the war.

Ukraine has a GDP of $148.71 billion and ranks among the worst-performing economies in 2024.

1. Sri Lanka

Sri Lanka is going through the worst crisis in its history as the country announced bankruptcy in July 2022. The country’s economy continues to shrink with indefinite economic problems on its way. Sri Lanka ranks first on our list of the worst economies in 2024.

Final Words

In conclusion, the global economy is moving through a challenging transition phase, marked by the lingering effects of the COVID-19 pandemic, geopolitical tensions, and supply chain disruptions. The IMF and other global economic organizations maintain a cautiously optimistic outlook for 2024 and 2024, pointing to signs of recovery, particularly in emerging markets and developing economies.

The business landscape remains diverse, with varying recovery trajectories across sectors. Tech and consumer discretionary sectors are demonstrating resilience and growth potential, driven by advances in AI and cloud services.

Nevertheless, many economies worldwide are struggling with economic stagnation or even contraction, facing a host of challenges from inflation and public debt to political instability and conflict. It’s crucial for these countries to adopt comprehensive economic recovery strategies to overcome their current challenges and promote sustainable growth.