Leasing is a big deal in the business world, but recent changes in accounting standards have made things more complicated. One of these standards is ASC 842, which is all about lease accounting. It was introduced to make things more transparent and comparable, giving people a clearer picture of an organization’s commitments and the risks involved. Basically, it means that most tenures need to be included on the balance sheet.

This article will break down ASC 842, explain how it affects business finances, and give you the important things to consider to make sure you’re following the rules. So, if you want to know more about this practice, how it could impact you, and what you need to keep in mind before implementing it, keep reading.

What is it and what are the basics you need to be aware of?

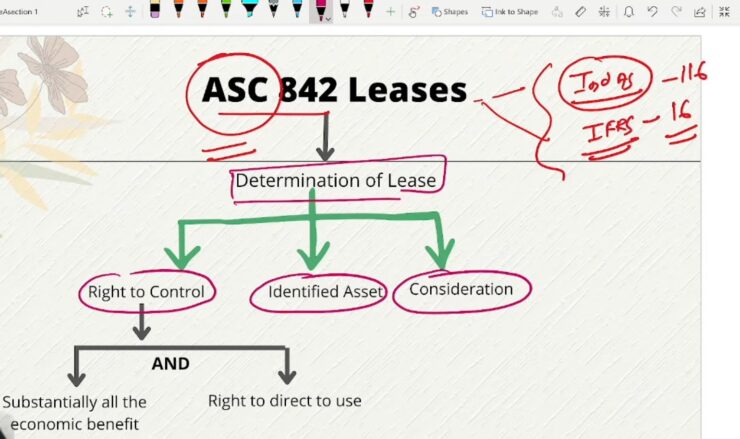

ASC 842 stands for Accounting Standards Codification Topic 842. It’s a set of rules designed to improve reporting by addressing concerns about tenures that were not previously included on the balance sheet. Before ASC 842, practices were divided into capital and operating models, but now most information has to be recognized on the balance sheet.

Under ASC 842, organizations have to record assets and liabilities for tenures with terms longer than twelve months. This helps give a clearer picture of an organization’s financial responsibilities and makes it easier for investors, analysts, and other stakeholders to make informed decisions.

But let’s be honest, all these rules can be a bit confusing, especially if you’re not a financial expert. That’s why it’s a good idea to talk to a professional who can guide you through the process and help you understand how it applies to your business. They can explain all the ins and outs, so you can make the best decisions for your brand. If you’re curious and want to dig deeper into this model, you can read more about ASC 842 here.

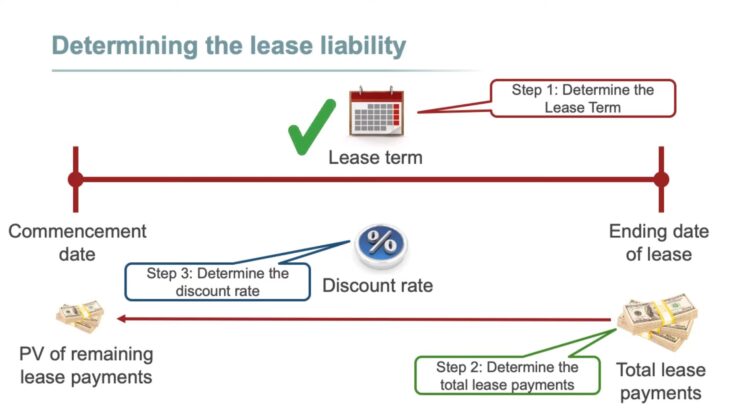

Additionally, this model adds some more complicated practices to accounting. For example, it makes us split bookings into different parts and consider discount rates. We have to carefully look at terms, like incentives, renewals, and changes, to figure out how long the agreement is and calculate the current value of potential payments. By understanding all these details, organizations can confidently handle their accounting, follow the rules, and give stakeholders clear and trustworthy financial information.

What is the impact this model may have on your organization?

ASC 842 has a big impact on financial statements. The balance sheet goes through some significant changes because now you have to include assets and liabilities. The former practice represents the right to use an asset, and they go under noncurrent assets. The latter practice, on the other hand, reflects the present value of future payments and appears as both current and noncurrent liabilities.

The income statement also changes because expenses are now divided into two parts. There’s the initial expense, which is the cost of using the given asset, and there’s the amortization of the model’s liability, which is the gradual reduction of the liability over time.

Even the cash flow statement is affected. Tenure payments, which used to be categorized as operating cash flows, are now split into principal and interest portions. The principal portion is considered a financing activity, while the interest portion is an operating activity.

On top of all that, there are new disclosure requirements. Brands have to provide more information about terms, payments, variable costs, and options to extend or terminate tenures. This extra information helps stakeholders understand a company’s lease portfolio and the risks and commitments involved. It’s all about transparency and building trust among those who rely on financial statements.

The impact of this model on your organization’s financial statements is significant. With the inclusion of all the needed practices on the balance sheet, there is greater visibility into your financial obligations and commitments. This transparency allows for better decision-making and assessment of your overall financial health. It also provides stakeholders with a more comprehensive understanding of your lease portfolio and associated risks. By adhering to ASC 842, you are not only ensuring compliance with accounting standards but also enhancing the accuracy and reliability of your financial statements, instilling confidence in investors, creditors, and other key stakeholders.

What do you need to be aware of before you start the implementation process?

Implementing ASC 842 is no small task, so here are a few things to keep in mind. First, you need to identify all the agreements within your organization and determine if they meet the criteria for recognition. This means looking at contracts, agreements, and other documents to see if they include this model’s components.

Once you’ve identified the tenures, you’ll need to gather all the necessary data, like terms, payments, and discount rates. Accurate data is crucial for calculating liabilities and assets. If you don’t have all the historical data you need, you might have to make estimates.

It’s also important to have the right systems and processes in place to track any modifications, reassessments, or changes that might come up. Accounting software can be a big help with automating calculations, keeping track of lease terms, and generating financial reports.

But perhaps the most important thing is communication. Make sure you’re open, honest, and transparent with everyone involved, including lenders, investors, and analysts. Explain the implementation process, why the changes are happening, and how they will impact financial statements. Good communication builds trust and understanding, making the transition smoother for everyone.

In conclusion

ASC 842 has brought significant changes to lease accounting. Organizations now have to include all relevant data on their balance sheets, providing more transparency and better information for decision-making. By understanding the implications of this and implementing the necessary changes effectively, organizations can ensure compliance with the new standards and improve their financial reporting and decision-making processes.

So, stay informed, be ready to adapt, and embrace the opportunities that ASC 842 brings to the world of lease accounting. Note that it may be fairly challenging for new brands to adopt this practice, so make sure you collaborate with the right services and professionals to figure out what would be the best for your brand, and how you can make the changes without any negative consequences or confusion.